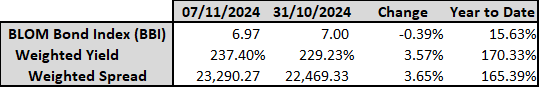

The BLOM Bond Index (BBI), which tracks Lebanese government Eurobonds (excluding coupon payments), dropped by 0.4% this week to 6.97 points, amid the ongoing Israeli-Hezbollah war.

Some analysts fear that Donald Trump becoming the new US president will further intensify the war in Lebanon. During his last term, Trump didn’t start new wars, but he did make existing conflicts in places like Afghanistan and Yemen more intense. In his victory speech, Trump promised to end wars. However, the Lebanon war started while Biden was president. Therefore, people aren’t sure what Trump will do about it. Some think he might act quickly to stop the fighting, while others worry he might make things worse.

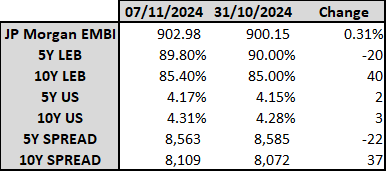

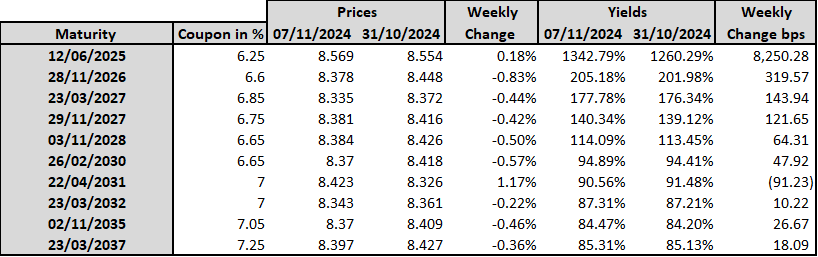

As bond prices decrease, yields increase. Consequently, the yield on 10-year bonds increased by 40 basis points this week to 85.4% as of November 7, 2024. Despite this, the yield on 5-year bonds decreased by 20 basis points during the same period to 89.8%.

In the U.S., Treasury yields have nearly returned to pre-election levels following Trump’s victory, with the yield curve slightly rising this week. One-year, five-year, and ten-year yields increased by 1, 2, and 3 basis points, respectively, reaching 4.28%, 4.17%, and 4.31% on November 7, 2024.

Trump’s deficit-boosting policies like tax cuts and increased tariffs are expected to boost inflation, making bonds less attractive and leading to lower bond prices. This has contributed to rising treasury yields. Meanwhile, the Federal Reserve cut interest rates by 0.25% to a range of 4.5-4.75% for the second consecutive time, moving more cautiously than before but still adjusting monetary policy. Fed Chair Jerome Powell noted that it is too early to determine how Trump’s policies might affect interest rates. The Fed also added that it shifted its focus to prioritize supporting employment alongside controlling inflation, acknowledging that the unemployment rate has increased slightly but remains low. Powell described this change as a “recalibration” of policy.

Amid these developments, traders are now pricing in a 71.3% chance of a quarter-point rate cut at the Federal Reserve’s December meeting, while the likelihood of no change is 28.7%, according to the CME Group’s FedWatch tool.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.