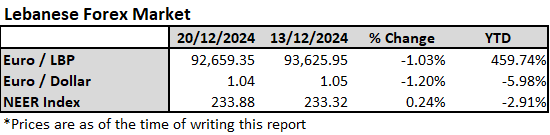

The Nominal Effective Exchange Rate (NEER) of the Lebanese pound rose by 0.24% this week against a basket of 21 influential currencies, including the Euro and British pound, and recorded 233.88 points on December 20th, 2024. This increase is due to the dollar’s strength, as the Lebanese Lira is pegged to the dollar.

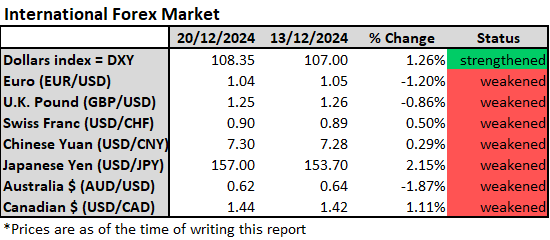

In international currency markets this week, the US Dollar index, a measure of the US currency’s strength against a basket of six rivals, rose by 1.26% to 108.35 points, its highest level since November 2022. This increase follows the Federal Reserve’s (Fed) new projections of only 2 quarter-point rate cuts in 2025, down from 4 in September’s outlook. The Fed also raised its GDP growth forecast for 2024 to 2.5% from 2%, and lowered its unemployment rate outlook. These changes have further strengthened the dollar, as a stronger economy attracts foreign investment, despite a higher inflation forecast for this year. The Fed’s 0.25% rate cut to 4.5% on Wednesday was already priced in by markets.

As the dollar strengthens, other currencies tend to weaken against it.

The euro fell by 1.2% against the dollar to 1.04 points, its lowest level since November 2022. Similarly, the British pound slid by 0.86% this week to 1.25. While the Bank of England held its rate unchanged at 4.75%, three members of the Monetary Policy Committee voted for a rate cut, contrary to expectations of more consensus for a hold.

In Asia, Japanese yen weakened to around 157 per dollar from 153.7. Japan’s headline inflation for November rose to 2.9%, the highest in 3 months, from 2.3% in October. Core inflation also exceeded expectations by 0.1%, reaching 2.7%. This data suggests more quantitative tightening from the BoJ despite it keeping rates at 0.25% at its December meeting. BoJ Governor Kazuo Ueda cited the need to assess wage negotiations to decide on policy.

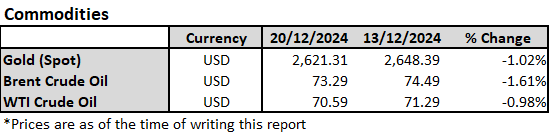

In commodity markets, Gold prices fell this week by 1.02% to $2,621.31/ounce. As the Fed announced a looser monetary policy for next year compared to September’s statement, gold became less appealing because it doesn’t provide any yields. Additionally, as the dollar strengthened, gold became more expensive for investors using other currencies.

In oil markets, both Brent and West Texas Intermediate prices fell this week by 1.61% and 0.98%, settling at $73.29 and $70.59 per barrel, respectively. A stronger dollar makes oil less appealing for other currency holders. Furthermore, China’s biggest refiner, Sinopec, expects the nation’s gasoline demand to have peaked last year, weakening the demand outlook for the world’s top crude importer next year. The decrease in oil prices comes despite reports from people familiar with the matter, according to Bloomberg, that the Group of Seven (G7) is considering tougher sanctions on Russian oil. Additionally, the US added nine vessels and eight companies to its sanctions list for their involvement in the trade of Iranian oil.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.