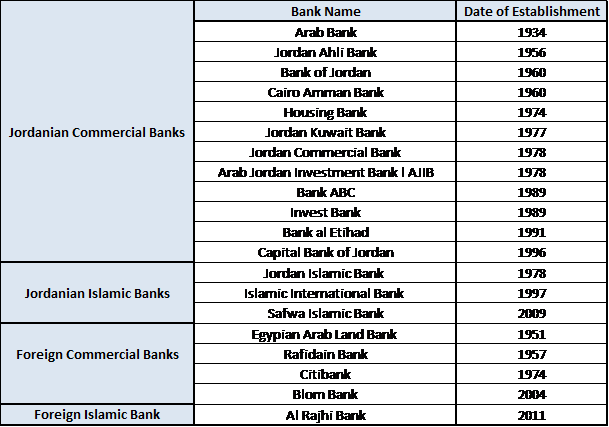

Jordan’s banking sector is characterized by a diverse structure comprising 20 banks, of which 15 are local and 5 are foreign, including 1 Lebanese bank. Among the local banks, 12 operate as commercial banks and 3 are Islamic banks, while foreign banks include 4 commercial banks and 1 Islamic bank. This composition highlights a strong representation of both conventional and Islamic banking models, catering to a wide range of financial needs in the Jordanian economy.

Source: Central Bank of Jordan, as reported by Union of Arab Banks

The banking network in Jordan continues to grow, with 870 branches operating across the country by the end of 2023, up from 865 branches in the previous year. This expansion was complemented by an increase in ATMs, rising from 2,202 to 2,321 during the same period. The total workforce in the sector exceeded 22,000 employees in 2023, reflecting its role as a key employer economic driver.

Source: Central Bank of Jordan, as reported by Union of Arab Banks

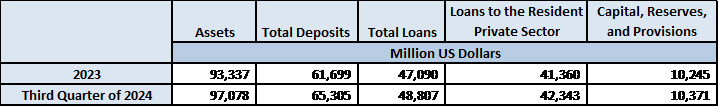

The table shows steady growth in the Jordanian banking sector from 2023 to the third quarter of 2024. With increases in assets, deposits, and loans reflecting economic activity and confidence. The rise in capital, reserves, and provisions seems to highlight financial stability and prudent management.

As for the top ten banks in Jordan, they dominate the sector holding approximately 82% of the total assets, amounting to $79.5 billion by the third quarter of 2024. These institutions collectively managed customer deposits totaling $61.7 billion and extended credit facilities worth $35.3 billion. The combined equity of these banks reached $9.5 billion, while their net profits stood at $1.1 billion, underscoring the sector’s profitability and resilience.

Lebanon has established a significant presence in the banking sector in Jordan. Blom Bank, first established in Jordan in 2004, is contributing to the sector’s diversity and offering regional expertise. It plays a pivotal role in facilitating trade and cross-border financial activities, particularly in areas of investment and trade financing.

The Jordanian banking sector exhibits robust financial health, supported by strong capital adequacy. By the end of 2023, the capital adequacy ratio stood at 17.9%, exceeding both the 12% requirement set by the Central Bank (CB) of Jordan and the 10.5% benchmark established by Basel committee. This reflects the sector’s ability to absorb shocks and maintain stability.

Despite geopolitical tensions in the region, the quality of assets remain high, with non-performing loans (NPLs) accounting for 5.1% of total loans by the end of 2023, a slight increase from 4.5% in 2022. Provisions for NPLs covered 75.6% of these loans, ensuring adequate risk management. Liquidity levels were also robust, with a liquidity ratio of 142.5% in 2023, comfortably above the 100% minimum requirement in Jordanian CB.

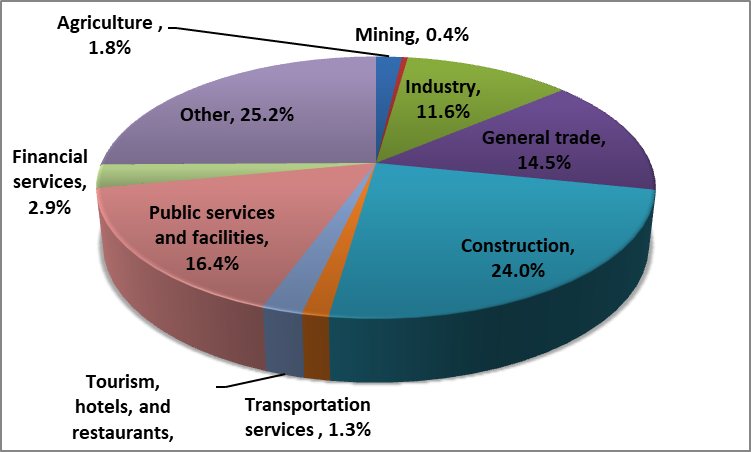

The distribution of credit facilities by Jordanian banks highlights their pivotal role in supporting key economic sectors. As of the end of 2023, four sectors received the majority of private sector credit:

Source: Central Bank of Jordan, as reported by Union of Arab Banks

This allocation underscores the sector’s contribution to vital areas of economic development, particularly in infrastructure, commerce, and industrial production.

The Jordanian banking sector serves as a backbone of the national economy, with its total assets equivalent to 190.8% of GDP, reflecting its substantial influence. By allocating credit facilities to critical sectors, banks should drive economic growth and job creation. However, the concentration of assets among the top banks presents a potential challenge to broader financial inclusivity and competition.

By: Jana Boumatar

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.