| Lebanese Forex Market | ||||

| 07/02/2025 | 31/01/2025 | % Change | YTD | |

| Euro / LBP | 93,035.25 | 93,106.85 | -0.08% | 462.01% |

| Euro / Dollar | 1.04 | 1.04 | 0.21% | -5.80% |

| NEER Index | 234.88 | 234.65 | 0.10% | -2.49% |

| *Prices are as of the time of writing this report | ||||

The Nominal Effective Exchange Rate (NEER) of the Lebanese pound edged up by 0.1% this week against a basket of 21 influential currencies, including the Euro and British pound, and recorded 234.88 points on February 7th, 2025.

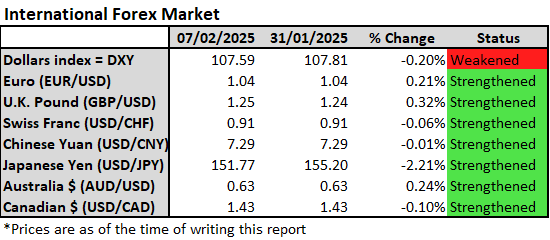

In international currency markets this week, the US Dollar index, a measure of the US currency’s strength against a basket of six rivals, fell by 0.2% to 107.59 points. This decline is attributed to analysts forecasting nonfarm payroll growth of 170K for January less than the 256K jobs added in December, with an unchanged unemployment rate of 4.1%. Earlier this week, US President Donald Trump threatened on imposing 25% tariffs over Canadian and Mexican imports, and 10% on Chinese imports. This move strengthened the dollar as investors sought safe-haven currencies. Later in the week, Trump postponed the tariffs on Canada and Mexico for a month but imposed them on China. This partial rollback in tariffs weakened the dollar as fears of a global trade war eased.

As the dollar weakened, other currencies tend to strengthen against it.

British pound rose by 0.3% to 1.25 points despite Bank of England cutting interest rates by 0.25%, as this move was already priced in by markets.

In Asian, Japanese Yen reached its highest level in nearly two months, as expectations grow that the Bank of Japan will keep on raising interest rates this year. The yen was also fueled by BOJ board member Naoki Tamura’s statement that the central bank should increase the key interest rate to around 1% by March 2026.

Chinese Yuan steadied this week at around 7.29 for the dollar as U.S.-China trade tensions began easing. After US imposed a 10% tariff over Chinese products, China reiterated and imposed tariffs on select U.S. imports staring February 10, 2025. However, Trump and his Chinese counterpart President Xi Jinping are expected to address trade developments in an upcoming call, which could pave the way for easing tensions.

| Commodities | ||||

| Currency | 07/02/2025 | 31/01/2025 | % Change | |

| Gold (Spot) | USD | 2,865.41 | 2,801.00 | 2.30% |

| Brent Crude Oil | USD | 74.92 | 75.67 | -0.99% |

| WTI Crude Oil | USD | 71.18 | 72.53 | -1.86% |

| *Prices are as of the time of writing this report | ||||

In commodity markets, Gold prices have surged this week, reaching near-record highs of $2,865.41/ounce as investors seek safe-haven assets amid geopolitical tensions, deglobalization fears, and as central banks increased their gold purchases. In fact, Trump has proposed that the US take control of the Gaza Strip for reconstruction. These tensions later eased as his officials suggested that any relocation would be only temporary. Adding to the uncertainty are the US-China trade war concerns and the potential for Trump to impose tariffs on other countries. Gold demand also rose as dealers in London rushed to transport the yellow metal to the US to avoid potential tariffs. Investors are also monitoring whether there are any side effects on the U.S. economy and monetary policy in case tariffs reignite inflation. In addition, in 2024, central banks sped up their gold purchases, buying over 1,000 tons for the third year in a row, as per the World Gold Council.

In oil markets, both Brent and West Texas Intermediate prices fell this week by 1% and 1.86%, settling at $75 and $71.2 per barrel, respectively. This drop happened because Trump wants to increase US oil production, and there are worries that China, the world’s biggest oil importer, might need less energy. These factors diminished the influence of other factors that typically drive oil prices higher, such as China’s new tariffs on US energy imports, the potential for US tariffs on Canadian oil, and recent increased sanctions on Iran aimed at eliminating their oil exports.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.