BDL compiled December 2024 data using the two below sources as per the IMF recommendation to align with the International Norms:

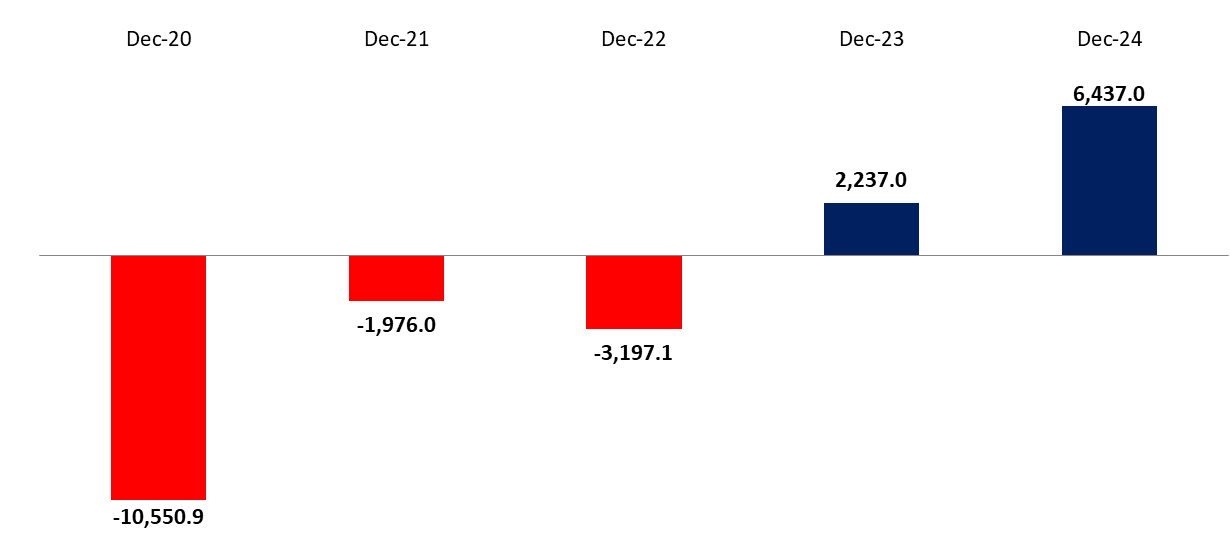

According to BDL’s latest monetary report, the BOP recorded a surplus of $6,437M in 2024, far higher than the surplus over the same period last year of $2,237M.

Based on the BDL Central Council’s Decision Number 37/20/24 dated 13/09/2024, BDL’s foreign assets starting January 2024 include the Monetary Gold, the Non-Resident Foreign Securities held by BDL, and the Foreign Currencies & Deposits with Correspondent Banks & International Organization; while excluding the Lebanese Government’s Sovereign Bonds and the BDL loans in FX to Resident Banks and Financial Institutions. The significant increase in the change of BDL NFA is mainly explained by the increase in the value of the Monetary Gold.

Accordingly, Net Foreign Assets (NFAs) of BDL rose by $5,714M while the NFAs of commercial banks increased by $723M in 2024.

In the month of December 2024, the NFA of BDL and commercial banks decreased by $502.5M and $289.9M respectively, generating a deficit of $792.4M.

For a meaningful analysis, we examine the NFAs of commercial banks for the month of December 2024. On the liabilities side, “Non-resident financial sector liabilities” decreased by $11.24M to reach $ 2.51B; similarly, “Non-resident customers’ deposits” declined by $8.55M to reach $20.91B. Meanwhile, on the asset side, “claims on non-resident financial sector” increased by $339.9M to reach $4.69B for the same period, while “other foreign assets” decreased by $65.25M to stand at $2.5B and “Non-resident securities portfolio” dropped by $6.8M recording $805.1M, and “claims on non-resident customers” dropped by $29.6M to reach $871.4M.

Balance of Payments (BoP) by December 2024 (in $M)

Source: BDL, BLOMINVEST

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.