Lebanese Forex Market | ||||

| 21/02/2025 | 17/02/2025 | % Change | YTD | |

| Euro / LBP | 93,760.20 | 93,778.10 | -0.02% | 466.39% |

| Euro / Dollar | 1.05 | 1.05 | -0.27% | -5.17% |

| NEER Index | 234.78 | 234.79 | 0.00% | -2.53% |

| *Prices are as of the time of writing this report | ||||

The Nominal Effective Exchange Rate (NEER) of the Lebanese pound stabilized this week against a basket of 21 influential currencies, including the Euro and British pound, and recorded 234.78 points on February 20th, 2025.

On a similar note, in a statement issued Wednesday, Banque du Liban (BDL) announced raising the withdrawal limit under Circular No. 158 to $500 per month and under Circular No. 166 to $250 per month, starting March 1, 2025. The central bank reiterated the necessity of issuing laws that guarantee the return of depositors’ funds, adding that it is actively working with the government and Parliament to achieve this objective.

| Circular | Previous Amount | New Amount |

| 158 | 300 or 400 USD Monthly | 500 USD Monthly |

| 166 | 150 USD Monthly | 250 USD Monthly |

The projected cost of the withdrawals increased to $100 million per month (totaling $1.2 billion annually). It is anticipated that 60% of this expense will be covered by the BDL, while the remaining 40% will be borne by commercial banks. This suggests that the BDL is confident in the local currency’s stabilization, the upward trend of foreign reserves, and expects to be able to meet its portion of the cost.

In fact, the Lebanese pound’s exchange rate has been fixed at 89,500 LBP per USD since early 2024, both in the black market and at Sayrafa rates, which has boosted confidence in the currency. Additionally, recent successive increases in the BDL’s foreign currency reserves have further strengthened the currency. By mid-February 2025, BDL’s Foreign Reserve Assets reached $10.53 billion. For more details on the latest BDL balance sheet, you can visit the full article here.

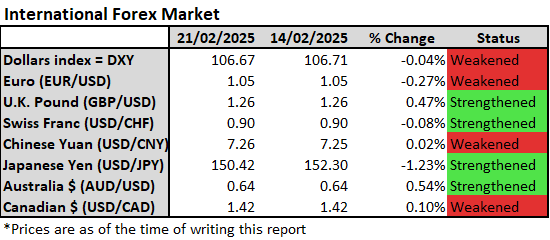

In international currency markets this week, the US Dollar index, a measure of the US currency’s strength against a basket of six rivals, inched lower by 0.04% to 106.67 points. On Thursday, it hit its lowest level since 10 December. This decline is attributed to U.S. President Donald Trump’s approach to tariffs being less severe than initially expected by markets.

The euro fell by 0.3% against the dollar this week to 1.05, on track for its third straight weekly decline against the USD. The drop comes as investors monitor Germany’s general election and assess the latest Eurozone PMI data, which remained stagnant in January at 50.2, below the 50.5 expectations. Meanwhile, geopolitical tensions and President Trump’s plans to impose a 25% tariff on key imports are adding uncertainty, particularly for European carmakers.

The British pound increased by 0.5% this week to 1.26, following a 1.7% rise in British retail sales in January. This surpassed the 0.3% growth forecasted by Reuters’ poll, indicating a boost in UK consumer spending.

The Japanese Yen strengthened by 1.23%, with current trading levels at 150.42 USD/JPY, driven by higher-than-expected inflation data in January, which showed a 3.2% increase in consumer prices excluding fresh food, rising from 3% in December and surpassing the 3.1% forecast. This raised expectations for further rate hikes by the Bank of Japan. Yet, statements from Bank of Japan (BOJ) chief Kazuo Ueda added caution to market sentiment as he affirmed the central bank’s continuous commitment to ensuring stable markets and avoiding further strengthening of the yen.

The Chinese Yuan slightly weakened this week despite some optimism that the U.S. and China might reach a deal to end their trade war. This followed President Trump’s statement on Wednesday that a trade agreement with Beijing was possible. He also mentioned that he expected Chinese President Xi Jinping to visit the United States, although he did not provide a specific date for the trip.

| Commodities | ||||

| Currency | 21/02/2025 | 14/02/2025 | % Change | |

| Gold (Spot) | USD | 2,930.85 | 2,883.18 | 1.65% |

| Brent Crude Oil | USD | 75.77 | 74.74 | 1.38% |

| WTI Crude Oil | USD | 71.75 | 70.74 | 1.43% |

| *Prices are as of the time of writing this report | ||||

In the commodity markets, gold rose for the 8th consecutive week, increasing by 1.65% to trade at $2,931 per ounce on Friday, close to the record high it reached during Thursday’s session. This rise was driven by increased demand for safe havens amid escalating geopolitical and trade tensions, along with concerns about their impact on the economic outlook. Since the start of Trump’s presidency on January 20, he has imposed an additional 10% tariff on Chinese products and a 25% tariff on steel and aluminum. Earlier in the week, he also announced plans for additional tariffs on lumber, cars, semiconductors, and pharmaceuticals. The demand for gold was further supported by concerns that Trump might withdraw U.S. support for Ukraine. Trump is planning to meet his Russian counterpart Vladimir Putin to negotiate a deal to end the war, which threatens to leave Kyiv and its European allies marginalized. The weaker dollar also boosted the dollar denominated metal. In addition, Goldman Sachs raised its year-end target for the metal to $3,100 per ounce this week, attributing the rise to central bank purchases.

In oil markets, Brent and West Texas Intermediate prices rose by around 1.4% this week, currently trading at $76 and $72 per barrel, respectively, amid supply uncertainty and rising demand.

On the supply side, OPEC+ is expected to postpone production hikes, citing a fragile market and previous difficulties in meeting reduced quotas. Russia also announced a 30%-40% decline in oil flow via the Caspian Pipeline Consortium, a crucial Kazakh crude export route, due to a Ukrainian drone strike on a pumping station. That said, depending on the Kremlin’s negotiation approach, developments in the Russia-Ukraine war could lead to shifts in sanctions on Russia, as per U.S. Treasury Secretary Scott Bessent, for better or worse.

On the demand side, J.P. Morgan’s analysis revealed that global oil consumption averaged 103.4 million barrels per day (bpd) up to February 19, marking a 1.4 million bpd rise. The analysis added that this rise in demand is projected to continue due to colder weather in the U.S. and a forecasted uptick in industrial activity in China as individuals return from holidays, thereby driving demand.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.