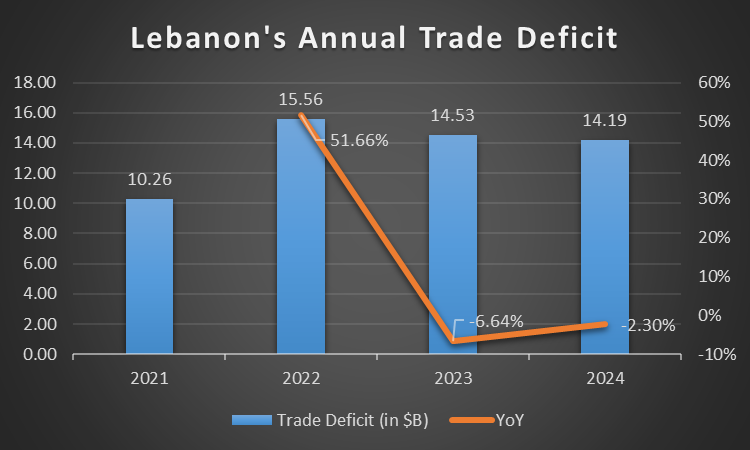

According to the Customs Administration, Lebanon’s trade deficit fell by 2.3% year-on-year (YoY) to $14.2 billion in 2024. Total imported goods dropped by 3.55% YoY to $16.9 billion, while total exports decreased by 9.6% YoY to $2.7 billion in 2024. The decline in imports and exports in Lebanon is primarily due to the Israeli-Hezbollah war and disruptions in the red-sea. Interestingly, import levels remained high despite the troubled 2024 year, mostly because it is widely recognized that Lebanese GDP is underestimated. To that effect, new, higher GDP estimates are now being put out by international institutions.

The decrease in imports reflects the reduced demand for non-essential goods amid the conflict. This is because:

The decrease in exports reflects the reduced demand for Lebanese goods during the war. This is because:

The top three import destinations in 2024 were China, Greece, and Switzerland, accounting for 11.55%, 8.65%, and 6.57% of the total value of imports, respectively. The total value of imported goods from these countries was $1.95 billion, $1.46 billion, and $1.11 billion. The top imported products were mineral products (25.96%) at $4.39 billion, pearls, precious stones, and metals (15.22%) at $2.57 billion, and products of the chemical or allied industries (8.23%) at $1.39 billion.

On the exports side, the top three destinations were the United Arab Emirates, Iraq, and Turkey capturing respective shares of 19.06%, 5.82%, and 5.67% of the total value of exports. The total value of exported goods to these countries was $516 million, $157 million, and $154 million. The top exported products were pearls, precious stones, and metals (21.14%) at $572 million, prepared foodstuffs, beverages, and tobacco (15.24%) at $412.6 million, and base metals and articles of base metal (15%) at $405.64 million.

Source: Customs Administration, BLOMINVEST

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.