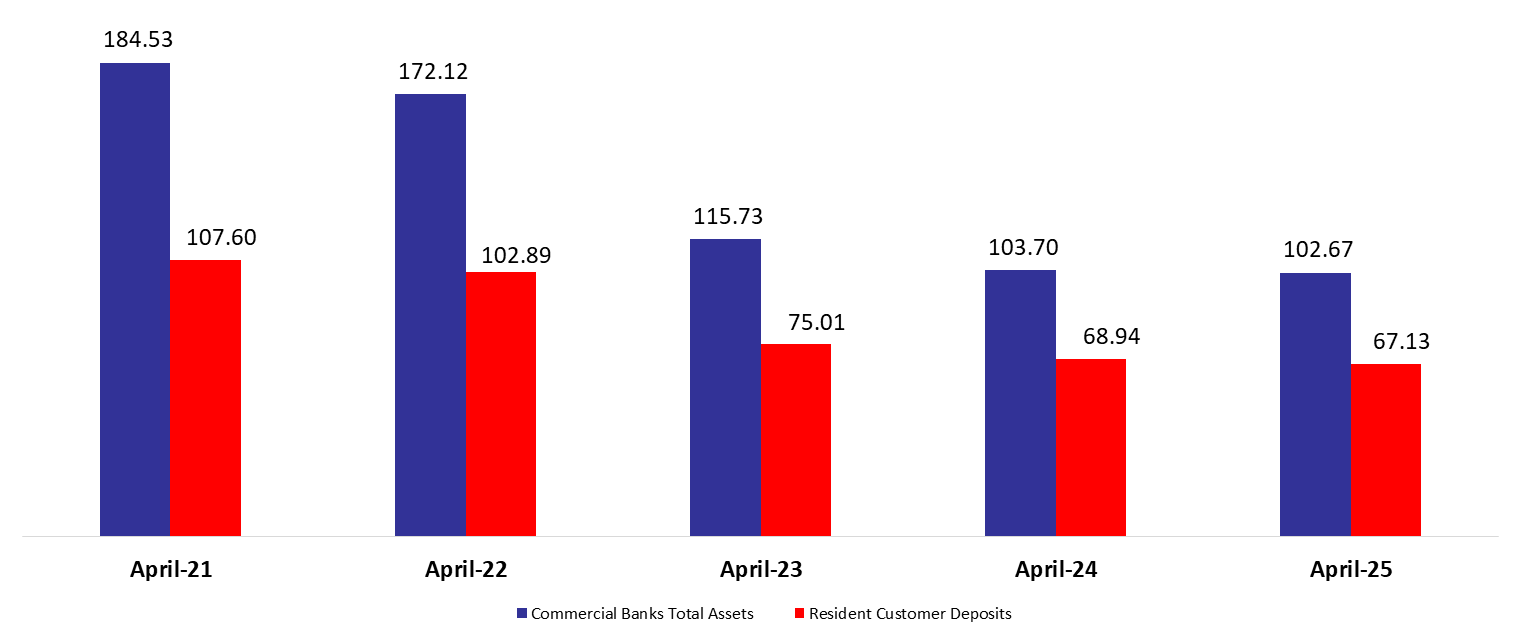

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets declined by 1% on year over year (YoY) basis to stand at $102.67B in April 2025 amid BDL’s adoption of a new exchange rate of LBP 89,500 per USD effective 31/01/2024.

On the assets side, currency and deposits with Central Bank represented a high figure of 77.41% of total assets; they dropped annually by 2.26% to settle at $79.48B in April 2025. Deposits with the central bank (BDL) represented 99.90% of total reserves, and decreased by 2.24% YoY, to reach $79.4B in April 2025. Furthermore, vault cash in Lebanese pound declined by 23.15% on a yearly basis to stand at $80.09M by the same period.

Claims on resident customers, constituting 4.41% of total assets, shrank by 22.40% to stand at $4.53B in April 2025. Moreover, resident securities portfolio, representing 5.25% of total assets, increased by 13.48% in April 2025 to stand at $5.4B. More specifically, the Eurobond holding recorded an increase of 3.74% since April 2024, to reach $2.3B (net of provisions) in April 2025. Additionally, claims on non-resident financial sector rose by 18.33% YoY to stand at $5.2B by April 2025.

On the liabilities side, resident customers’ deposits were the main account, representing 65.38% of total liabilities; they dropped by 2.62% since April 2024 to reach $67.13B by the month of April 2025. In more details, deposits in foreign currencies (being 98.75% of resident customers’ deposits) declined by 3.03% YoY to reach $66.3B by April 2025, additionally deposits in LBP (1.25% of resident customers’ deposits) increased by 45.50% YoY to stand at $836.96M by April 2025. This reveals that a slightly higher proportion of deposits are now held in LBP, as the dollarization ratio for private sector deposits decreased from 99.31% in April 2024 to 98.99% in April 2025.

As for non-resident customers’ deposits, grasping 20.64% of total liabilities, they recorded a rise of 1.12% and stood at $21.2B in April 2025. In details, the deposits in LBP rose by 1.27% to reach $31.61M and deposits in foreign currencies increased by 1.12% to reach $21.16B over the same period. In addition, non-resident financial sector liabilities representing 2.51% of total liabilities and decreased by 2.89% YoY to reach $2.6B in April 2025.

Lastly, the capital accounts stood at $4.3B, higher by 52.78% than April 2024, noting that only about 10% of those are in LBP.

Commercial Banks Total Assets and Resident Customer Deposits in April 2025 ($B)

Source: BDL, BLOMINVEST

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.