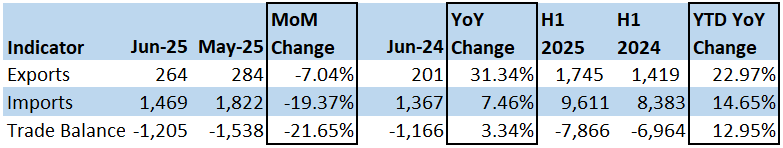

According to the Lebanese Customs Administration, Lebanon’s trade deficit widened by 12.95% year-over-year (YoY) to $7.87 billion in the first half (H1) of 2025. The shift was primarily driven by a 14.65% YoY surge in imports, which reached $9.611 billion, offsetting a 22.97% YoY rise in exports to $1.745 billion over the same period.

Imports rose as consumer behavior readjusted amid easing geopolitical tensions, with individuals spending more freely rather than limiting their consumption to stockpiling essentials.

On the export side, the increase likely signals a rebound in business activity across multiple regions following the November 2024 ceasefire with Israel. While Israel has continued to breach the agreement, these disruptions have remained localized, allowing broader commercial operations to resume and drive export growth.

That is in addition to the freer trade routes through Syria, especially since the fall of the previous regime.

On a monthly basis, both exports and imports declined as rising tensions surrounding the Iran-Israel conflict and potential U.S. involvement raised trade costs. Insurance premiums surged, and disruptions via air and sea intensified due to flight suspensions to Lebanon and port delays linked to regional security concerns and airport closures in Iraq and Jordan.

Lebanon’s Trade Balance (USD Million)

YTD: Year to Date

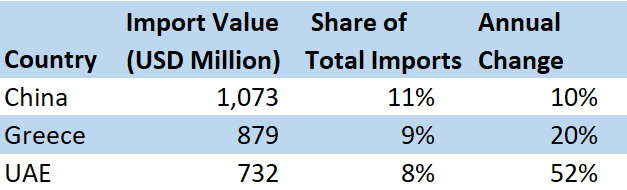

The top three import destinations in H1 2025 were China, Greece, and United Arab Emirates (UAE), accounting for 11%, 9%, and 8% of the total value of imports, respectively. The top imported products were mineral products (24%) at $2,311 million, pearls, precious stones, and metals (17%) at $1,628 million, and products of the chemical or allied industries (8%) at $796 million.

Top Import Destinations for Lebanon (H1 2025)

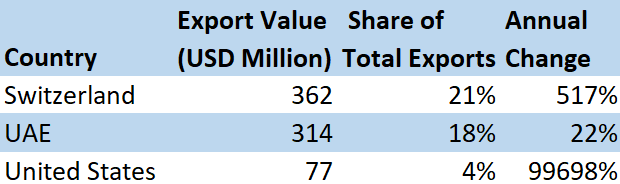

On the exports side, the top three destinations in H1 2025 were Switzerland, UAE and United States capturing respective shares of 21%, 18%, and 4% of the total value of exports. The top exported products were pearls, precious stones, and metals (36%) at $631 million, base metals and articles of base metal (15%) at $268 million, and prepared foodstuffs, beverages, and tobacco (12%) at $211 million.

Top Export Destinations for Lebanon (H1 2025)

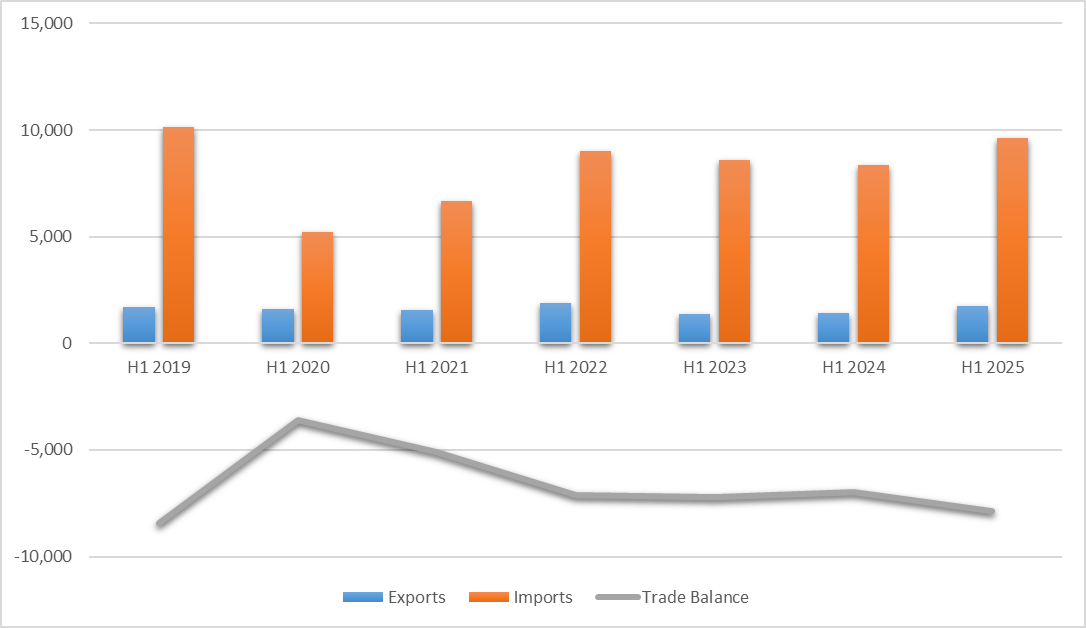

Unfortunately, Lebanon’s trade balance did not benefit meaningfully from the currency devaluation throughout the post-crisis years, as it now stands near pre-crisis levels. Exports almost match H1 2019 levels, reflecting the country’s limited range of internationally competitive products and the absence of trade agreements to support existing competitive products and services or encourage new ones. On the import side, volumes have rebounded to just below pre-crisis levels, indicating a partial recovery in financial capabilities, as individuals increasingly afford goods they previously could.

Lebanon’s Trade Balance (USD Million): 2019–2025

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.