Bank Audi published on 19 September 2025 its non-audited consolidated financial results for Q2 2025. It stated that “in light of the process of political renewal and progress towards IMF engagement in early 2025, the Bank continues to support long-awaited reforms, advocate for a viable restructuring framework, and implement measures to fortify the Bank’s readiness post the expected resolution plan.

In this context, parliament enacted the Bank Restructuring Law in August 2025 at long last, which is a crucial step after the amendment to the Banking Secrecy Law. We now look forward to the adoption of the Financial Gap Framework in the near future. In the meantime, it is still difficult for banks to assess the full negative impact of the crisis on their financial position.

Also, the bank continues with the adopted direction to allocate consolidated operating surpluses to provisions for risk and charges in Q2 2025, as a cautious measure to reinforce the Bank’s financial position under the prevailing conditions of uncertainty.

In terms of strategy, the Bank is redefining its retail business model in Lebanon by transitioning toward a convenient, readily accessible and cost effective digital platform mainly for individual customers (neo) while consolidating our branch network to better serve high-net-worth and corporate clients”.

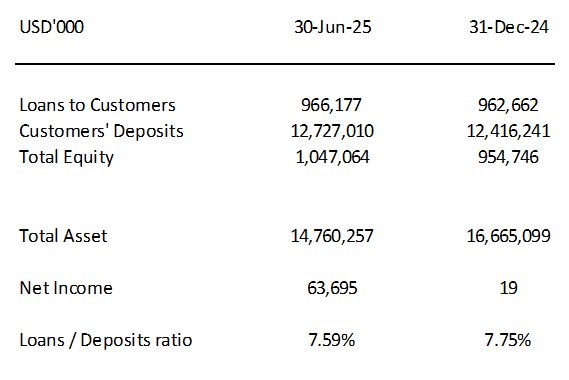

Moreover, it stated that the “figures below were published to comply with regulatory publishing requirements for listed banks operating in Lebanon. They should not be relied upon for decision-making, and they should be read in conjunction with the full set of financial statements and related disclosures as published on the Bank’s website (please refer to the 2024 Annual Report)”.

For Q2 2025, Bank Audi’s net profits amounted to $63.69 million compared to $12,000 in Q2 2024. As to assets, they stood at $14.76 billion, less by 11.43% relative to end 2024; deposits reached $12.73 billion, up by 2.50%; loans stood at $0.966 billion, higher by 0.37%; and shareholders’ equity was $1.05 billion, higher by 9.67%.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.