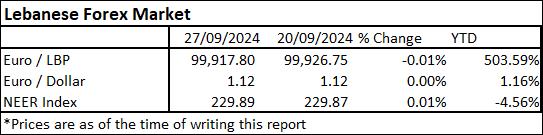

The Nominal Effective Exchange Rate (NEER) of the Lebanese pound traded stably this week against a basket of 21 influential currencies, including the US Dollar and Euro, and recorded 229.89 points on September 27th, 2024. Since the start of the year, we notice that the NEER Index fell by 4.56%. The decline is attributed to the US Dollar’s sharp decline this year, which led to a decrease in the Lebanese Lira’s valuation against other currencies since the Lebanese Lira’s conversion rate to the US Dollar has been stable since January 2024.

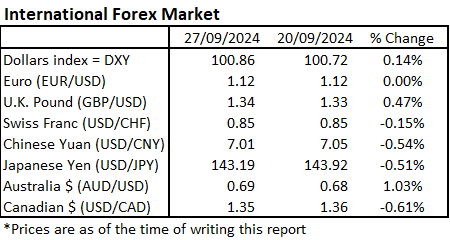

In international currency markets this week, the US Dollar index, a measure of the US currency’s strength against a basket of six rivals, inched slightly higher by 0.14% to 100.86. This move comes as traders are closely monitoring the upcoming PCE price index report, which is the Federal Reserve’s preferred measure of inflation, to understand how quickly interest rates might be cut in the future. Additionally, new data showed that weekly jobless claims dropped to a four-month low, suggesting a strong labor market, which supports the dollar’s value.

The euro held steady at 1.12, just below its recent 14-month high, while the British pound strengthened to 1.34, up 0.47%, to remain near its peak since March 2022.

Meanwhile, the Swiss franc remained stable at 0.85, trading near its highest level against the dollar in a decade amid cautious monetary policy from its central bank.

In Asian forex markets, China’s stimulus measures, such as lowering bank reserve requirements, boosted the Chinese yuan and Australian dollar. The yuan gained 0.54% against the dollar to 7.01, while the Aussie rose 1% to 0.69, nearing multi-year highs on optimism over China’s economic support.

Similarly, the yen strengthened against the dollar to equal 143.19 JPY for 1 US Dollar compared to 143.92 JPY last week after Shigeru Ishiba’s victory in Japan’s ruling party, which suggested potential backing for the Bank of Japan’s gradual rate hike plans.

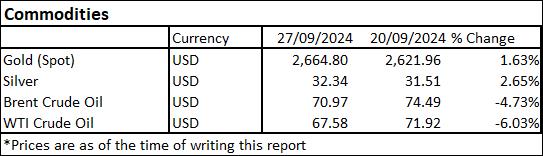

In commodity markets, both oil benchmarks fell this week, with Brent crude dropping to $70.97 and WTI decreasing to $67.58, representing declines of 4.73% and 6.03% respectively. The drop in prices was largely influenced by reduced supply worries. From one side, OPEC+, which is currently reducing output by 5.86 million barrels per day, announced plans to increase supply by 180,000 barrels per day in December. This decision coincides with reports that Saudi Arabia may abandon its informal $100 per barrel price target to regain market share, according to sources cited by the Financial Times. From another side, a recent political agreement among rival factions in Libya to resolve their dispute over the Central Bank is expected to restore significant oil production. At the same time, demand concerns persist, particularly from China, despite recent monetary measures aimed at stimulating economic activity and increasing energy consumption in the world’s largest crude importer, adding more pressure to oil prices.

As for precious metals, Gold and silver prices surged this week, with gold reaching $2,664.80 on September 27, up 1.63% from the previous week, while silver climbed to $32.34, to trade near its highest level since December 2012. The rally in precious metals was fueled by a combination of factors, including renewed investor interest following significant stimulus measures announced by China to boost its economy and expectations of further interest rate cuts by the Federal reserve. At the same time, as geopolitical tensions rise, investors are increasingly turning to gold and silver as safe-haven assets. Silver’s impressive performance is also supported by strong industrial demand, particularly in renewable energy technologies like solar panels.

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.