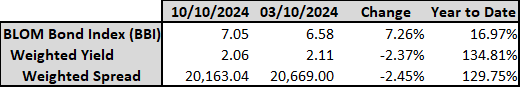

The BLOM Bond Index (BBI), which tracks Lebanese government Eurobonds (excluding coupon payments), rose 7.26% to 7.05 points on October 10, 2024. This rise brings it close to its highest level since the Israeli-Hezbollah war began about a year ago. This move is driven by optimism that Hezbollah’s weakening may lead to a ceasefire, potentially stabilizing the country and ending the prolonged default on these bonds.

Earlier this week, the U.S. expressed support for electing a new president in Lebanon. Yet, even with a new leader, debt restructuring will require a strong commitment to necessary reforms. Given the current political deadlock, achieving meaningful progress seems unlikely.

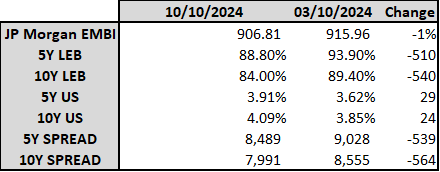

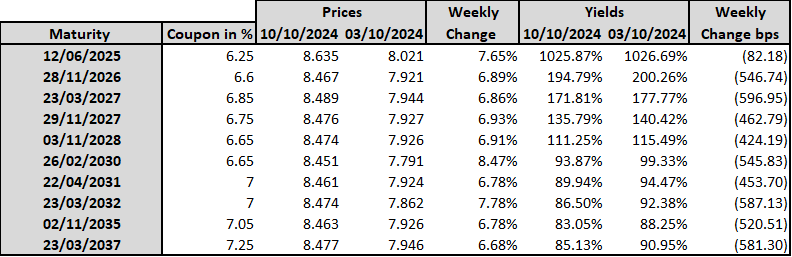

As bond prices rise, yields decrease. Consequently, the yields on 5-year and 10-year Lebanese Eurobonds fell this week by 510 bps and 540 bps, respectively, reaching 88.8% and 84% by October 10, 2024.

In the U.S., the yield curve shifted upward this week, with one-year, five-year, and ten-year yields rising by 20, 29, and 24 bps, respectively, to stand at 4.22%, 3.91%, and 4.09% on October 10, 2024.

The ten-year US Treasury yield increased this week to 4.09% from 3.85%. This increase reflects shifting expectations among traders as recent jobs and inflation data have tempered hopes for a larger half-percentage point cut.

That said, initial jobless claims recorded 258K, the highest level in 14 months, while U.S. inflation slightly exceeded expectations, falling to 2.4% annually in September from 2.5% in August.

Additionally, Atlanta’s Federal Reserve President Raphael Bostic told the Wall Street Journal that he is open to the possibility of no rate cuts in November.

These developments have led some analysts to reconsider the likelihood of aggressive rate cuts. Traders are now pricing in an 84.3% chance of a quarter-point rate cut at the Federal Reserve’s November meeting, while the likelihood of no change is just 15.7%, according to the CME Group’s FedWatch tool.

Weekly Change of Lebanese Eurobonds Prices

Source: BLOMINVEST Bank

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.