| 31/10/2024 | 24/10/2024 | Change | Year to Date | |

| BLOM Bond Index (BBI) | 7.00 | 7.08 | -1.13% | 16.08% |

| Weighted Yield | 229.23% | 218.84% | 4.74% | 161.02% |

| Weighted Spread | 22,469.33 | 21,426.49 | 4.87% | 156.03% |

| 31/10/2024 | 24/10/2024 | Change | |

| JP Morgan EMBI | 900.15 | 900.23 | -0.01% |

| 5Y LEB | 90.00% | 88.90% | 110 |

| 10Y LEB | 85.00% | 83.70% | 130 |

| 5Y US | 4.15% | 4.03% | 12 |

| 10Y US | 4.28% | 4.21% | 7 |

| 5Y SPREAD | 8,585 | 8,487 | 98 |

| 10Y SPREAD | 8,072 | 7,949 | 123 |

The BLOM Bond Index (BBI), which tracks Lebanese government Eurobonds (excluding coupon payments), dropped by 1.13% this week to 7 points, amid Israel’s ongoing aggression on Lebanon.

On the political front, several ceasefire reports were circulated this week, with some hinting at a potential agreement before the US election. Lebanese caretaker Prime Minister Najib Mikati said he was hopeful about a potential treaty to be announced within few days. However, Hezbollah’s new leader, Naim Qassem, mentioned that the group would consider a ceasefire with Israel only if the terms were appropriate and suitable.

On the Economic front, investor concerns about Lebanon’s economic stability are rising. Last Friday, the Financial Action Task Force (FATF) placed Lebanon on its grey list for failing to combat money laundering and terrorist financing. This grey listing signals an elevated country risk, leading to lower demand for Lebanese bonds, and consequently falling prices.

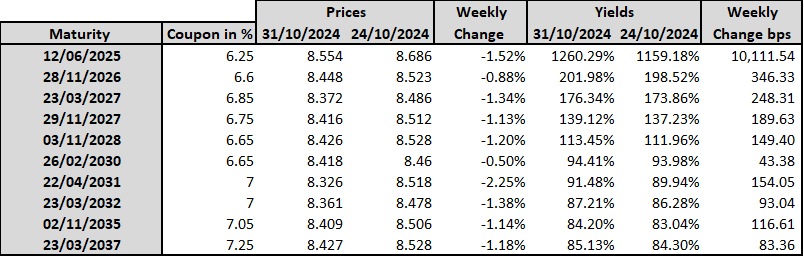

As bond prices decrease, yields increase. Consequently, the yields on 5-year and 10-year Lebanese Eurobonds rose this week by 110 and 130 basis points, respectively, reaching 90% and 85% by October 31, 2024.

Similarly, in the U.S., the yield curve shifted upward this week, with one-year, five-year, and ten-year yields rising by 2, 12, and 7 bps, respectively, to stand at 4.27%, 4.15%, and 4.28% on October 31, 2024. The benchmark 10-year Treasury yield recorded its highest level since July.

This increase is driven by signs of a stronger economy, as initial filings for unemployment benefits decreased by 16,000 to record 216,000 for the week ending October 26, below the 230,000 forecast, which could lead to smaller interest rate cuts in the Federal Reserve’s upcoming meetings.

Additionally, the US presidential election is witnessing a tight competition. If former President Donald Trump wins, he will adopt deficit-boosting policies that will increase inflation levels. This will decrease bonds’ attractiveness and lead to lower bond prices.

Amid these developments, traders are now pricing in a 93% chance of a quarter-point rate cut at the Federal Reserve’s November meeting, while the likelihood of no change is just 7%, according to the CME Group’s FedWatch tool.

| 5Y Credit Default Swaps (CDS) | ||

| 31/10/2024 | 24/10/2024 | |

| KSA | 63.49 | 66.91 |

| Dubai | 64.52 | 65.80 |

| Brazil | 160.51 | 161.35 |

| Turkey | 270.72 | 274.87 |

| Source: Bloomberg | ||

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.