Trump’s Victory Shakes Forex and Commodities Markets

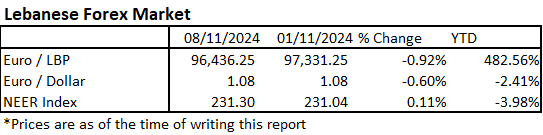

The Nominal Effective Exchange Rate (NEER) of the Lebanese pound increased marginally by 0.1% this week against a basket of 21 influential currencies, including the US Dollar and Euro, and recorded 231.3 points on November 8th, 2024. This move is supported by the dollar’s strengthening this week after Donald Trump won the US election.

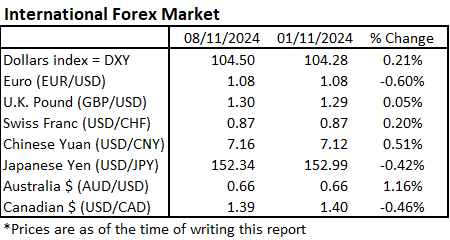

In international currency markets this week, the US Dollar index, a measure of the US currency’s strength against a basket of six rivals, rose by 0.2% to 104.5 points. This increase followed the Republican Party winning the presidency and gaining a majority in the Senate. There are also expectations that they will secure a majority in the House of Representatives. These outcomes are likely to help Trump pass legislation such as tax cuts and increasing spending. These policies are expected to stimulate the U.S. economy and increase inflation. Although the Federal Reserve (Fed) cut interest rates by 0.25% to 4.5-4.75%, but Trump’s inflation concerns and the Fed’s careful approach to future rate cuts points out to slower future cuts. This could make the dollar stronger against other currencies.

The euro fell by 0.6% this week against the dollar, reaching 1.08 points. Trump’s presidency is expected to weaken the euro due to his protectionist policies, like imposing tariffs on imports, which could slow down the euro area’s economic growth. As a result, the European Central Bank (ECB) might adopt a looser monetary policy to support the economy. Meanwhile, the Fed might adopt a stricter policy to control inflation. These contrasting policies are expected to weaken the euro further.

Regarding the British pound, it inched higher by 0.05% this week to 1.3 following the Bank of England (BOE)’s rate cut by 0.25% to 4.75%.

In Asian forex markets, Chinese Yuan weakened to 7.16 per dollar from 7.12 last week due to a stronger dollar and as Trump’s threat to impose 60% tariffs on Chinese goods. In response, China announced a 10 trillion yuan ($1.4tn) fiscal package to refinance local government debt. However, investors were not impressed by this move, leading them to pull out of the yuan, which caused its value to decrease further against the dollar.

In contrast, Japanese yen strengthened against the dollar after Japan’s top currency diplomat, Atsushi Mimura, said the government will take action against “excess moves” in the yen, which follows the dollar’s rise after Trump’s victory.

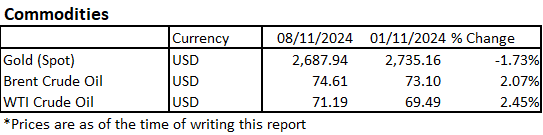

In commodity markets, Gold prices fell this week by 1.7% to $2,688/ounce due to the “Trump effect”. His win strengthened the dollar, making gold more expensive for investors using other currencies. Additionally, gold is less attractive during high-interest-rate periods because it doesn’t offer any yield. This scenario is expected with Trump’s inflationary policies. Thirdly, gold is often used as a hedge during geopolitical tensions. Trump’s promise to stop wars in his election-night victory speech eased geopolitical tensions fears. Despite this, analysts think his policies could increase government spending, widen the US budget deficit, and raise public debt. This situation might end up supporting the gold’s position as a safe-haven asset.

As for both oil benchmarks, Brent and West Texas Intermediate (WTI) prices rose by 2.1% and 2.45% respectively recording $74.6/barrel and $71.2/barrel. On the supply side, Trump’s policies are expected to limit supply by tightening sanctions on Iran and Venezuela. Potential changes in sanctions imposed on Russian oil remain uncertain and depend on a possible peace deal with Ukraine. Additionally, OPEC+ extended oil production cuts until the end of December, further limiting supply. On the demand side, a strong dollar makes oil less attractive as it becomes more expensive for other currency holders. Furthermore, crude imports in China, the world’s biggest oil importer, decreased by 9% in October for the sixth month in a row.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.