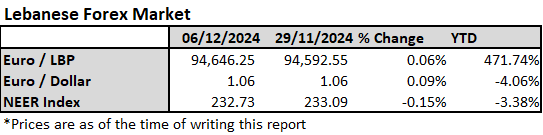

The Nominal Effective Exchange Rate (NEER) of the Lebanese pound decreased marginally by 0.15% this week against a basket of 21 influential currencies, including the US Dollar and Euro, and recorded 232.73 points on December 6th, 2024. This decline is due to the weakening dollar, as the Lebanese Lira is pegged to the dollar.

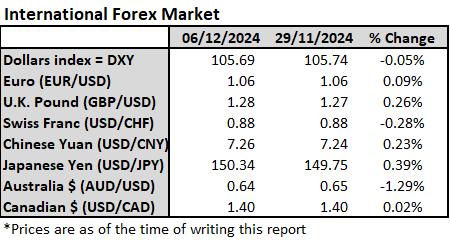

In international currency markets this week, the US Dollar index, a measure of the US currency’s strength against a basket of six rivals, fell this week by 0.05% to 105.69 points. Today, the November nonfarm payrolls report is expected to show around 200K new jobs. A weaker-than-expected level could increase rate cuts chances in the US Federal Reserve’s (Fed) next meeting, pulling the US dollar down.

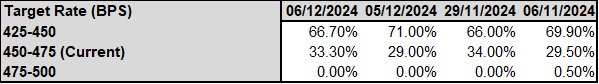

Markets see a 66.7% chance the Fed will cut rates by 0.25% in December, down from 69.9% a month ago. There’s a 33.3% chance rates will stay the same, according to the CME FedWatch tool.

The euro remained under pressure at 1.06 points. December is usually the euro’s strongest month, averaging a 1.6% gain against the U.S. dollar over the past 24 years, based on Euronews’ calculations. However, political instability in Europe, especially in France, and US tariff threats could disrupt the euro’s usual rally this year. For now, the European Central Bank (ECB) isn’t expected to respond to the political turmoil in the bloc during its next meeting. A Reuters poll of 75 economists shows that all but two expect the ECB to cut rates by 0.25% on December 12.

The British pound rose by 0.26% this week to 1.28 points after Bank of England Governor Andrew Bailey hinted that the Central Bank might cut rate 4 times in 2024 if inflation keeps declining.

In Asia, both the Chinese Yuan and Japanese Yen weakened. While policymaker Toyoaki Nakamura’s openness to a rate hike gave some support to the yen, it still fell over the week. The Chinese Yuan was expected to benefit from upcoming stimulus measures from Beijing in December. However, high expectations that China’s struggling economy will push the central bank towards more monetary easing, combined with rising trade tensions, kept investors wary.

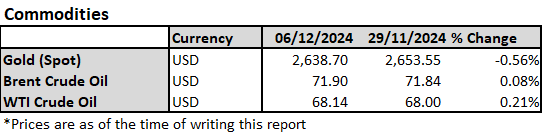

In commodities markets, Gold prices fell this week by 0.56% to $2,639/ounce, despite the US dollar’s weakening. Reduced expectations for Fed rate cuts make gold less attractive since it does not provide any yield.

In oil markets, both Brent and West Texas Intermediate prices rose slightly this week by 0.08% and 0.21%, settling at $71.90 and $68.14 per barrel, respectively. This increase followed the Organization of the Petroleum Exporting Countries and its allies (OPEC+) extending their supply cuts of 2.2million barrels daily for 3 additional months. In other words, OPEC+ will increase supply starting April 2025, but at a slower pace. Previously, the group was going to bring supply back to 2.2m b/d within 12 months. Currently, this period extended to 18 months. So, full supply will be back by September 2026. While OPEC+’s moves limit supply, oil markets are expected to remain in the surplus zone in the first half of 2025. This surplus will likely lead to a decrease in oil prices next year as non-OPEC supply is increasing and demand is still weak, particularly in China.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.