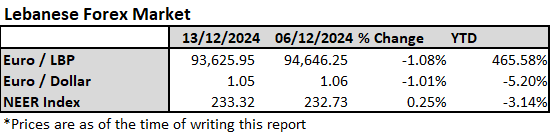

The Nominal Effective Exchange Rate (NEER) of the Lebanese pound rose by 0.25% this week against a basket of 21 influential currencies, including the US Dollar and Euro, and recorded 233.32 points on December 13th, 2024. This increase is due to the dollar’s strength, as the Lebanese Lira is pegged to the dollar.

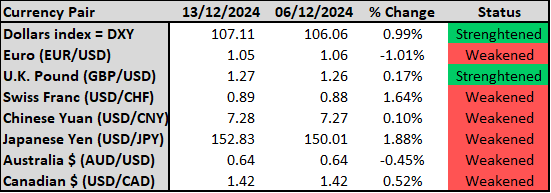

In international currency markets this week, the US Dollar index, a measure of the US currency’s strength against a basket of six rivals, rose this week by 1% to 107.11 points. The increase in US inflation to 2.7% in November from 2.6% in October suggests that the Federal Reserve (Fed) might cut rates in its next meeting. However, the Fed is expected to take a cautious approach to further cuts, boosting the dollar, especially as other central banks are expected to cut rates more aggressively.

The euro fell by 1% against the dollar to 1.05 as the European Central Bank (ECB) cut rates by 0.25% on Thursday. ECB president Christine Lagarde hinted at more rate cuts next year, noting that the pace will be decided at future meetings.

The British pound edged up by 0.17% this week to 1.27 points. The Swiss Franc weakened between December 6, 2024, and December 13, 2024, as indicated by a 1.64% change from 0.88 to 0.89. This move is due to a surprise half-point rate cut by the Swiss National Bank.

In Asia, Japanese yen weakened to around 153 per dollar from 150 last week amid expectations that the Bank of Japan may avoid raising rates in its next meeting. Chinese Yuan remained almost stable at 7.28 for the dollar.

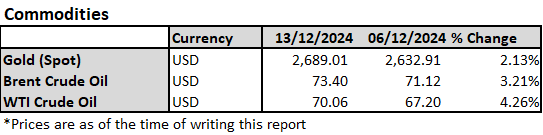

Over the past week, commodity prices have risen. Gold (Spot) increased by 2.13% to $2,689 per ounce, driven by reports of China resuming gold purchases and expectations of a Fed rate cut. Brent Crude Oil rose 3.21% to $73.4 per barrel, and WTI Crude Oil jumped 4.26% to $70 per barrel. These increases are due to worries about supply disruptions from tighter sanctions on Russia and Iran, and a potential rise in Chinese demand following stimulus measures.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.