Discover today’s performance of BLOM indices, the closing prices of Lebanese stocks and Eurobonds, as well as the exchange rate of major currencies against the LBP.

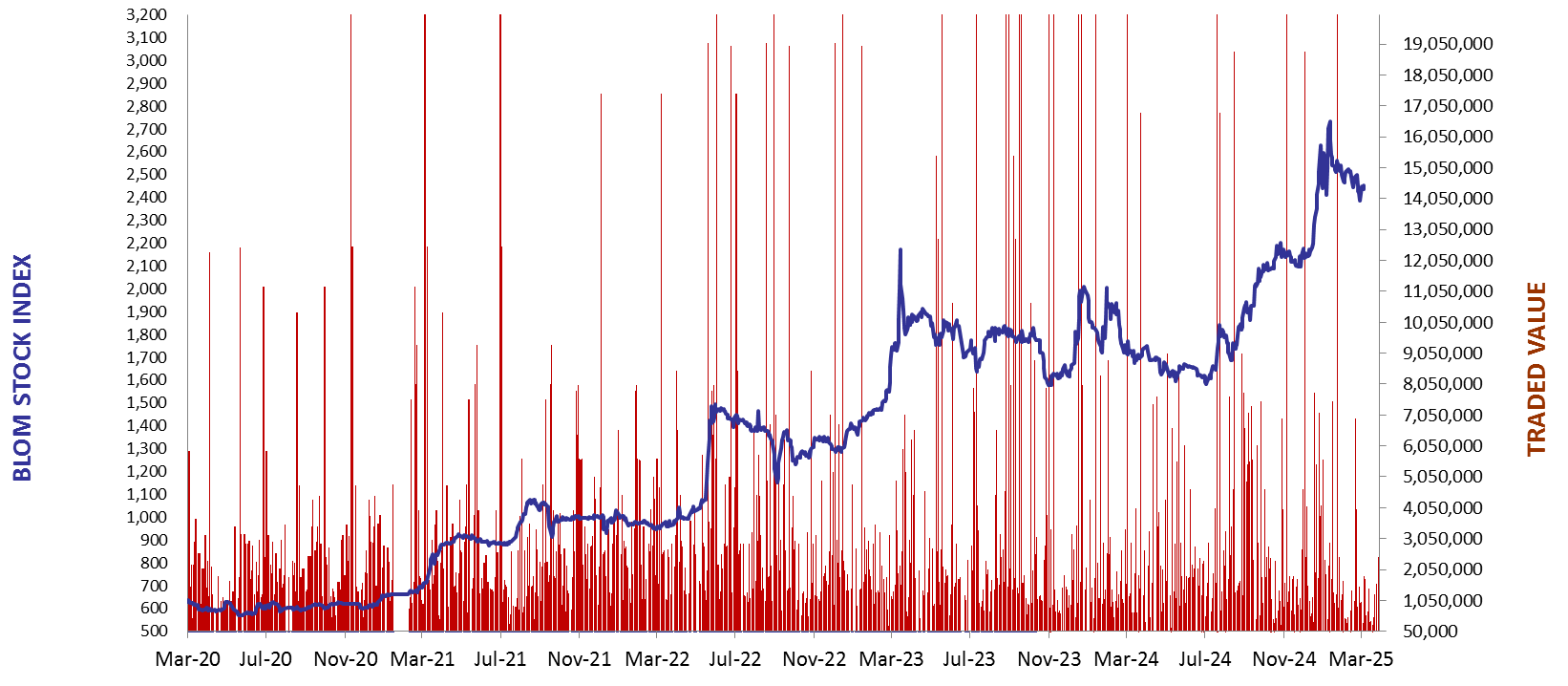

BLOM Stock Index (BSI) – today’s performance

| Last | Previous | % Change | Y-t-D Change | |

| BSI | 1,944.71 | 1,969.98 | -1.28% | -25.99% |

| Volume | 22,540 | 74,373 | ||

| Val ($) | 810,521 | 1,150,280 |

I): BLOM preferred Shares Index (BPSI): today’s Performance

| Last | Previous | Change | |

| BPSI | 20.22 | 20.22 | 0.00% |

Lebanese Stocks: today’s Trades and Closing Prices

| Last Price ($) | % Change | Volume | VWAP ($) | |

| Solidere A | 78.30 | -1.63% | 7,490 | 78.48 |

| Solidere B | 78.80 | -1.50% | 2,500 | 78.80 |

| Bank Audi | 2.97 | 0.00% | 3,000 | 3.0 |

| Byblos Bank – Listed Shares | 0.85 | 0.00% | 8,000 | 0.90 |

| BLOM GDR | 6.46 | -9.65% | 1,550 | 6.50 |

Closing Date: August 25, 2025

The BLOM Stock Index

BLOM BOND INDEX: Last Session’s Performance

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 20.23 | 20.21 | 0.09% | 52.22% | |

| Weighted Yield | 103.00% | 102.92% | 8 | bps | |

| Duration (Years) | 2.18 | 2.18 | |||

| 5Y Bond Yield | 97.10% | 97.00% | 10 | bps | |

| 5Y Spread* | 9,334 | 9,314 | 20 | bps | |

| 10Y Bond Yield | 64.60% | 64.50% | 10 | bps | |

| 10Y Spread* | 6,034 | 6,017 | 17 | bps |

*spread between Lebanese Eurobonds and US Treasuries

| Price | Yield | Yield Change | |

| 28/11/2026 | 19.55 | 201.48% | 105 |

| 23/03/2027 | 19.50 | 156.57% | 68 |

| 29/11/2027 | 19.50 | 107.11% | 38 |

| 03/11/2028 | 19.51 | 78.05% | 17 |

| 26/02/2030 | 19.58 | 59.62% | (7) |

| 22/04/2031 | 19.53 | 52.28% | 15 |

| 23/03/2032 | 19.51 | 48.08% | 14 |

| 02/11/2035 | 19.51 | 40.07% | 9 |

| 23/03/2037 | 19.50 | 39.61% | 4 |

Closing Date: August 22, 2025

Lebanese Forex Market

| Last Price | Previous | % Change | |

| $/LBP | 89,500 | 89,500 | – |

| €/LBP | 104,661.30 | 104,849.25 | -0.18% |

| £/LBP | 120,735.50 | 121,021.90 | -0.24% |

| NEER | 241.47 | 241.57 | -0.04% |

Closing Date: August 25, 2025