Outstanding Loans to the Private Sector Stagnated in Q1 2015

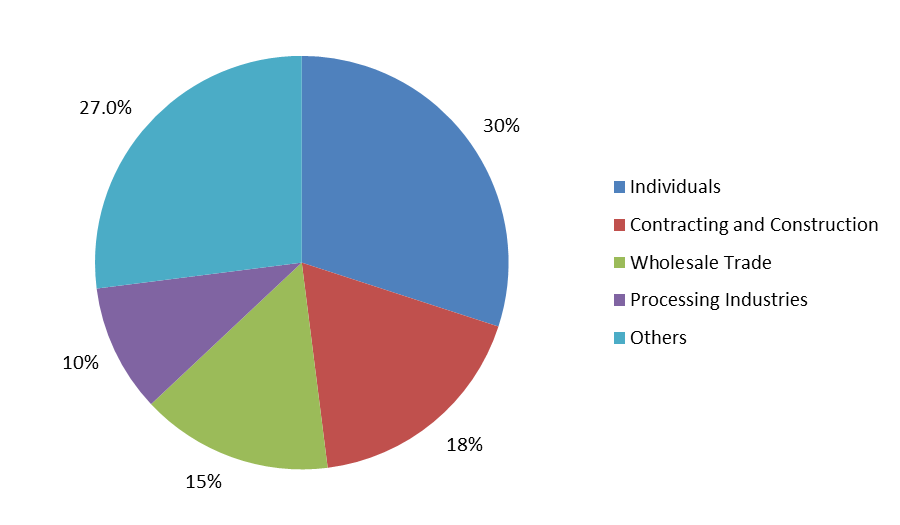

According to the Central Bank of Lebanon, the value of outstanding loans to the private sector rose by 0.47% since year-start to $54.17B by March 2015. The largest category of these disbursed loans is the category of individual loans with a share of 30%, followed by a share of 18% for contracting and construction, 15% for wholesale trade and 10% for processing industries. To give a glimpse over the banks’ exposure to real estate, the sum of the value of housing loans and contracting and construction loans represents 37% of the total loans disbursed in the financial sector.

In terms of individual loans as a whole, they slid by a slight 0.03% year-to-date to $16.52B. The value of housing loans increased by 2% since year start to reach $10.06B by March while consumption loans saw their value fall by 2% to reach $4.31B and car loans also decreased by 3% to $1.44B.

In terms of contracting and construction, the value of loans increased by 2% to $9.75B.

Meanwhile, wholesale trade loans saw their value drop by 2% to $8.25B by March. In fact, loans dedicated for foodstuffs and beverages rose by 4% to $1.64B but that was outweighed by the 19% drop in loans disbursed in the category of oil and oil products.

Finally, loans handed for processing industries saw their value grow by a mere 0.17% since year start and totaled $5.65B by March 2015.

Biggest Categories Benefiting from Loans, March 2015

Source: Banque du Liban