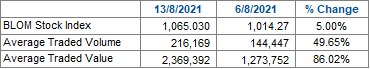

The BLOM Stock Index (BSI) compiled by BLOMInvest Bank on a daily basis increased by 5.00% from last week to reach 1,065.030 on August 13, 2021. The Market capitalization on the Beirut Stock Exchange (BSE) increased from $10.39B to $10.91B on August 13, 2021. Moreover, the average volume and value of trades during the week ending August 13, 2021 totaled 216,169 shares worth $2,369,392 compared to 144,447 shares worth $1,273,752 during last week.

This week in Lebanon, fuel crisis has reached a dramatic point that marked a new low in the financial crisis that occurred in late 2019. Businesses, hospitals and bakeries are shutting down completely due to fuel shortage, making life even harder for the Lebanese population. Meanwhile, the government is still sparring with the central bank over its decision to end fuel subsidies, an inevitable step that would push sharply higher prices.

Regionally, the major Arab markets witnessed a better performance this week. In details, the S&P Pan Arab and S&P AFE 40 index, increased weekly by 1.11%, and 0.97%, respectively. Meanwhile, the MSCI index decreased slightly by 0.71% compared to last week. In the Arab World, the bourse of UAE, Saudi Arabia and Bahrain were the top gainers this week, and witnessed an increase of 2.36%, 1.02% and 1.00%, respectively, compared to last week.

On the Beirut Stock Exchange (BSE), the real estate sector grasped the lion’s share of the BSE’s trading value with a stake of 70.79%, while the banking grasped the rest with a stake of 29.21%. The most noteworthy trades throughout the mentioned period included:

As for the BLOM Preferred Shares Index (BPSI), it decreased from 45.57 points to 45.06 points by the end of this week.

This week, the BSI is still on a steady increase due to the soaring prices of Solidere. In turn, Real Estate sector is showing strong trade on the exchange market due to the rising uncertainty of the financial and economic situation in the country. Real assets are the best bet in crisis times!