The IMF updated its World Economic Outlook (WEO) projections on January 30, 2024, as justified by the fact that “global activity proved resilient in the second half of last year, as demand and supply factors supported major economies. On the demand side, stronger private and government spending sustained activity, despite tight monetary conditions. On the supply side, increased labor force participation, mended supply chains and cheaper energy and commodity prices, all helped despite renewed geopolitical uncertainties”.

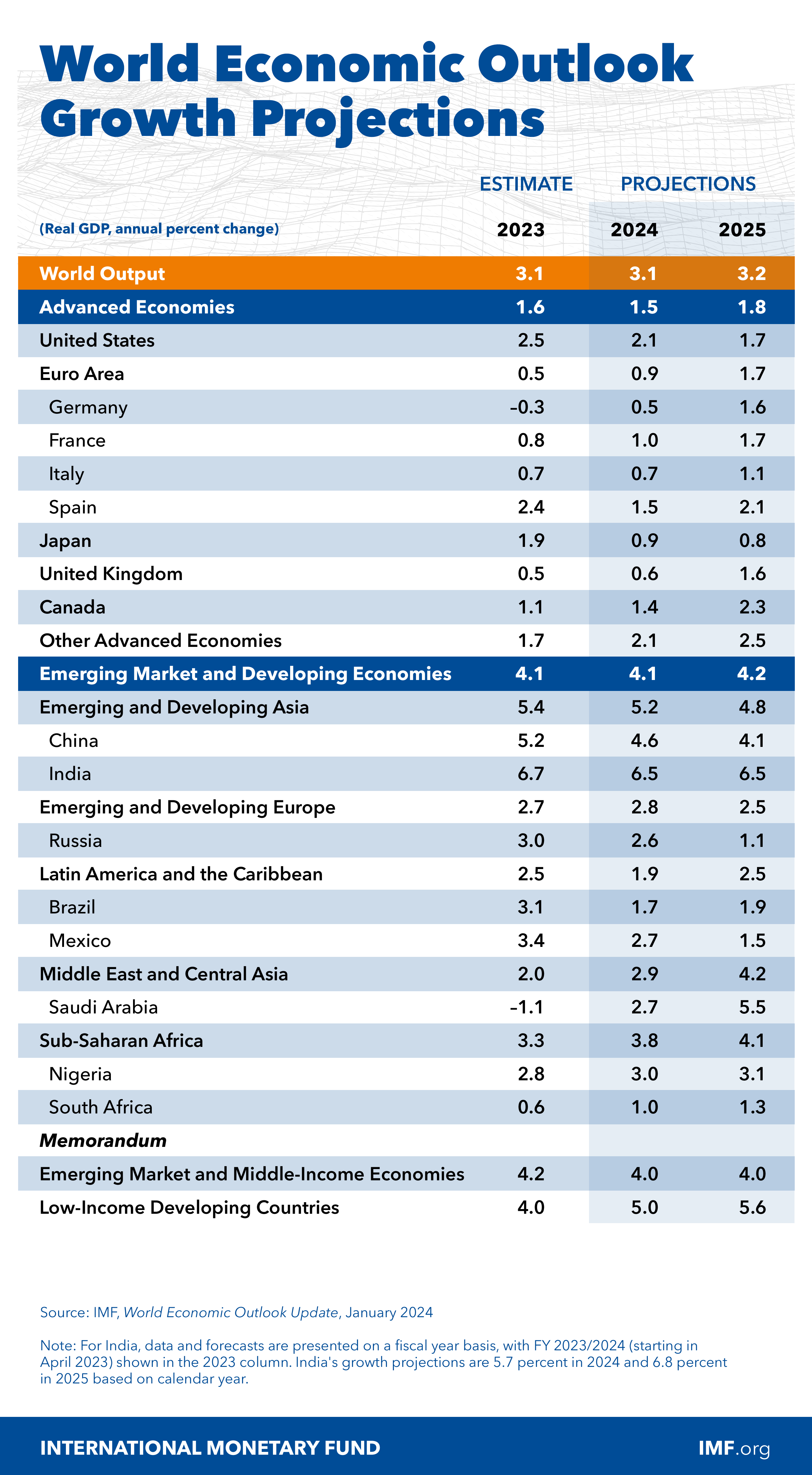

As such, it postulated that “global growth under our baseline forecast will steady at 3.1 percent this year, a 0.2 percentage point upgrade from our October projections, before edging up to 3.2 percent next year”. However, all is not rosy as “important divergences remain. We expect slower growth in the United States, where tight monetary policy is still working through the economy, and in China, where weaker consumption and investment continue to weigh on activity. In the euro area, meanwhile, activity is expected to rebound slightly after a challenging 2023, when high energy prices and tight monetary policy restricted demand. Many other economies continue to show great resilience, with growth accelerating in Brazil, India, and Southeast Asia’s major economies”.

In the case of inflation, the update argued that “Inflation continues to ease. Excluding Argentina, global headline inflation will decline to 4.9 percent this year, down 0.4 percentage points from our October projection (also excluding Argentina). Core inflation, excluding volatile food and energy prices, is also trending lower. For advanced economies, headline and core inflation will average around 2.6 percent this year, close to central banks’ inflation targets”.

In addition, with the improved outlook, risks have moderated and are balanced. As a result, “On the upside: i) Disinflation could happen faster than anticipated, especially if labor market tightness eases further and short-term inflation expectations continue to decline, allowing central banks to ease sooner; ii) Fiscal consolidation measures that governments have announced for 2024-25 may be delayed as many countries face rising calls for increased public spending in what is the biggest global election year in history, and this could boost economic activity, but also spur inflation and increase the prospect of disruption later; iii) Looking further ahead, rapid improvement in Artificial Intelligence could boost investment and spur rapid productivity growth, albeit one with significant challenges for workers. On the downside: i) New commodity and supply disruptions could occur, following renewed geopolitical tensions, especially in the Middle East. Shipping costs between Asia and Europe have increased markedly, as Red Sea attacks reroute cargoes around Africa, while disruptions remain limited so far, the situation remains volatile; ii) Core inflation could prove more persistent as the price of goods remains historically elevated relative to that of services, and the adjustment could take the form of more persistent services—and overall—inflation. Wage developments, particularly in the euro area, where negotiated wages are still on the rise, could add to price pressures; iii) Markets appear excessively optimistic about the prospects for early rate cuts. Should investors re-assess their view, long-term interest rates would increase, and putting renewed pressure on governments to implement more rapid fiscal consolidation that could weigh on economic growth”.

In terms of policy challenges, the WEO states that “the biggest challenge ahead of us is to tackle elevated fiscal risks. Most countries came out of the pandemic and energy crisis with higher public debt levels and borrowing costs. Bringing down public debt and deficits will give space to deal with future shocks”. And in this context, it argues that “remaining fiscal measures introduced to offset high energy prices should be phased out right away, as the energy crisis is behind us. But more is needed. The danger is two-fold. The most pressing risk is that countries do too little. Fiscal fragilities will build up until the risk of a fiscal crisis forces sudden and disruptive adjustments, at great cost. The other risk, already relevant for some countries, is to do too much, too soon, in the hope of convincing markets of ones’ fiscal rectitude. This could endanger growth prospects. It would also make it much harder to address imminent fiscal challenges such as the climate transition”.

Lastly, the WEO adds that “reforms that ease the most binding constraints to economic activity, such as governance, business regulation and external sector reform, can help unleash latent productivity gains, our research shows. Stronger growth could also come from limiting geo-economic fragmentation by, for instance, removing the trade barriers that are impeding trade flows between different geopolitical blocs, including in low-carbon technology products that are crucially needed by emerging and developing countries”.