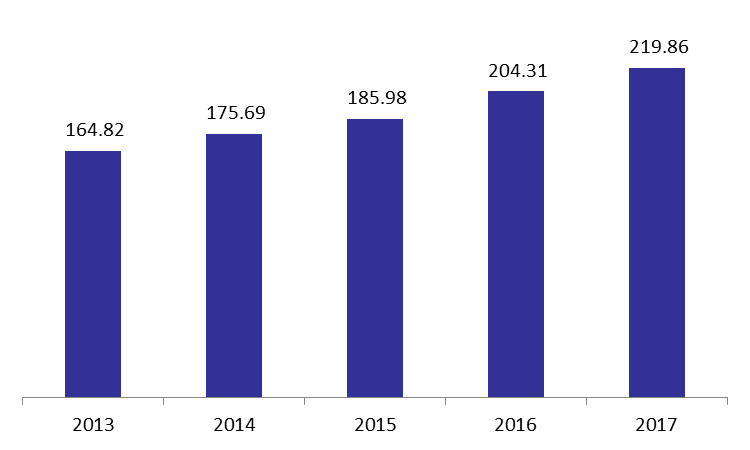

The balance sheet of Lebanon’s commercial banks revealed that total assets grew by a yearly 7.6%, to reach $219.86B in 2017 compared to $204.31B in December 2016.

In details, Reserves (47.27% of total assets) recorded a rise of 15.8% year-on-year (y-o-y) to $103.92B, on the back of Deposits with the central bank rising by an annual 15.8% to $103.41B. Claims on the resident private sector (24.64% of total assets) also added 6.1% y-o-y, to stand at $54.17B.

In their turn, Foreign assets (10.73 of total) climbed by an annual 2.2% to $23.6B by Dec. 2017. The rise can be attributed to the annual 5.3% uptick registered in Claims on non-resident financial sector to $11.83B in 2017.

However, Claims on public sector (14.53% of total assets) dropped by 8% y-o-y by December 2017 to $31.95B. The decrease can be primarily justified by the lower subscription to T-bills in LBP and Eurobonds, which dropped by 8.2% y-o-y and 7.8% y-o-y to $17.62B and $14.18B, respectively.

On the liabilities side, the dollarization ratio of private sector deposits rose from 65.82% in 2016 to 68.72% in 2017. This is mainly attributed to the November 2017 Prime Minister resignation crisis which prompted depositors to either transfer savings out of the country, or alternately exchange their LBP deposits to USD as they lost confidence amid the security and political crisis in the country. In details, Resident and Non-resident private sector deposits in LBP fell by 4.9% y-o-y and 5.7% y-o-y to settle at $48.49B and $4.27B, respectively, in 2017. Nonetheless, the declines in LBP deposits were offset by yearly upticks of 9.7% and 4.9% in resident private deposits in foreign currencies (FC) and non-resident private sector deposits in FC, to end the year at $85.02B and $30.88B, respectively.

Commercial Banks’ Assets, In $B

Source: Central Bank of Lebanon