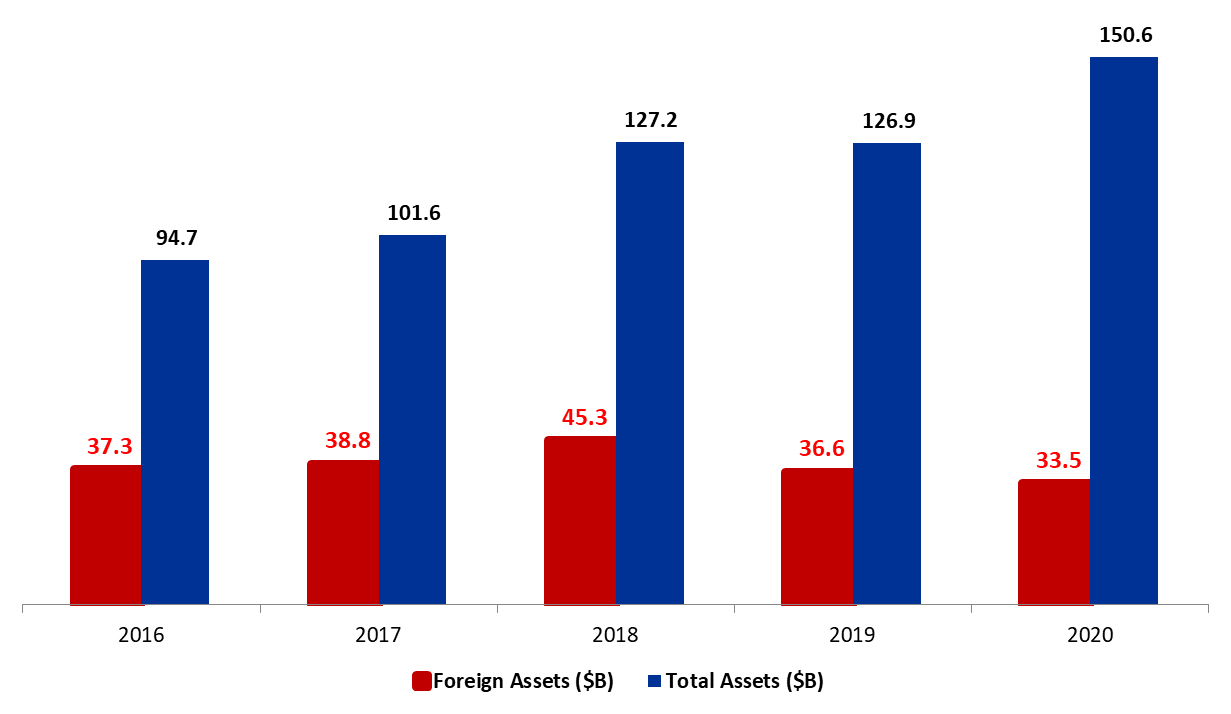

According to the central bank’s (BDL) balance sheet, total assets rose by 6.53% since year-start, to stand at $150.58B by May 2020. In fact, this can be mainly attributed to the rise in “Gold” account (10.57% of total asset) by 14.18% to reach $15.91B by May 2020.

BDL foreign assets (constituting 22.26% of total assets) recorded a year to date (YTD) decline by 10.08% ($3.75B) to reach $33.51B by May 2020. Worth mentioning that since the end of April till the end of May, foreign assets retreated by $907M.This continues to be attributed to BDL covering the costs of importing essential goods that now includes food, food raw materials, and raw materials for industry.

Meanwhile, BDL’s Securities portfolio (25.62%of total assets) added 1.57% YTD to settle at $38.58B by May 2020. In their turn, Loans to the local financial sector in LBP (9.78% of total assets) witnessed a downtick by 1.44% to $14.72B by May 2020. Moreover, BDL’s Other Assets (23.63%of total assets) rose by 42.55% YTD to reach $35.58B by May 2020.

On the liabilities side, Financial Sector Deposits (74.49% of BDL’s total liabilities) rose by 0.14% YTD to settle at $112.16B by May 2020, while Public sector deposits (2.83% of total liabilities) decreased by 21.67% YTD to stand at $4.26B over the same period, as the government was withdrawing these deposits to cover its increasing budget deficit. It is worth mentioning that Currency in Circulation (7.86% of BDL’s total liabilities) rose by 68.93% YTD to stand at $11.84B in May 2020. In fact, the increase in Currency in circulation is due to the BDL increase in money supply, following a series of circulars allowing depositors with foreign currency accounts to withdraw cash in Lebanese lira close to the market rate.

BDL Foreign and Total Assets by May

Source:BDL