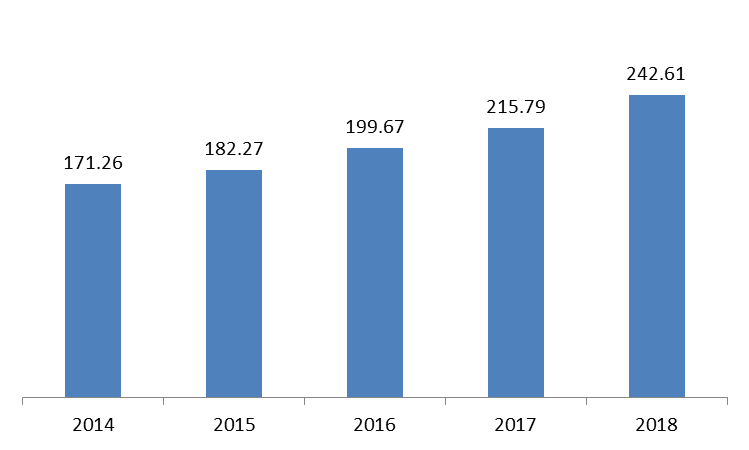

According to Lebanon’s commercial banks’ balance sheet, total assets witnessed an uprise of 10.35% year-to-date (y-t-d) to stand at $242.61B by October 2018.

In details, deposits with BDL, constituting 52.04% of the total assets, endorsed a rise of 22.10% to $126.26B.Meanwhile, Claims on resident customers (21.36% of total assets) declined by 3.03% y-t-d to stand at $51.83B by October 2018. In details, both, the claims on resident customers in Lebanese pound and in foreign currencies observed respective drops of 2.35% and 3.35% during the same period to stand at $16.98B and $34.84B.

As for the Claims on non-resident customers (2.82% of total only), they registered an increase of 12.73% to settle at $6.84B by October 2018.

Worth mentioning, subscription to Eurobonds increased by 18.89% since the beginning of the year to stand at $16.86B by October 2018,while subscription to T-bills decreased by 7.37% y-t-d to $16.32B.

On the liabilities side, Resident customers’ deposits (55.49% of total liabilities) witnessed an increase of 1.04% y-t-d to reach $134.62B by October 2018.In details, the 2.31% increase in foreign currencies deposits to $86.77B offset the 1.19% decrease in deposits in LBP to $47.85B in October 2018.

Non-resident customers deposits (15.45% of the total liabilities) witnessed an increase of 6.64% since the beginning of the year to $37.49B .this was mainly due to the increase in both, deposits in foreign currencies and in LBP by 6.68% and 6.33% respectively to $32.95B and $4.54B respectively.

As such, the dollarization ratio of private sector deposits rose from 68.72% in December 2017 to 69.51% in October 2018.

Commercial Banks’ Total assets by October (in $Billions)

Source :BDL