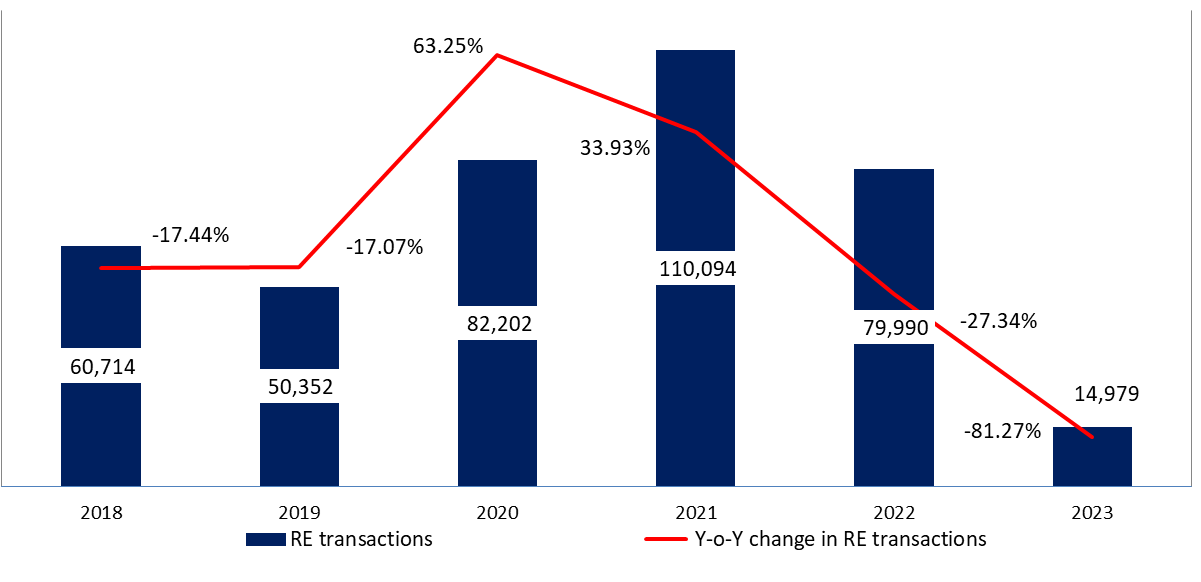

According to the data from the General Directorate of Land Registry and Cadastre (LRC), the number of Real estate (RE) transactions recorded a sharp fall of 81.27% yearly to stand at 14,979 transactions by end of 2023, compared to 79,990 transactions same period last year. The drop is mainly due to the ongoing nation-wide strike for the public employees which have led to major dysfunction for public services. In the same token, the value of total RE transactions stood at $4.12B by December 2023 calculated at the new official rate of USD/LBP 15,000, which is 71.26% lower than $14.36B in last year.

On a monthly basis, the number of RE transactions stood at 3,340 in the month of December 2023, compared to 2,610 transactions in the same month previous year and 3,805 transactions in November 2023. In details, South region holds the biggest share of real estate transactions at 835, or 25% of total RE transactions, in the month of December 2023, followed by North at 768 transactions or 22.99% of total RE transactions. Furthermore, Zahle grasped 22.96% of total RE activity in December 2023, and 12.84% or 429 transactions was the share that the Nabatieh grasped out of the total RE transactions, while Beirut held 412 transactions or 12.34%. Noting that no RE transactions was recorded in the area of Metn, Kesserwen, and Baabda for the month of December 2023.

Moreover, the breakdown of RE activity by value for December 2023 showed that Beirut grasped the lion’s share of the total value of RE transactions, equivalent to 50.75% and worth $517.13M, while the South followed, constituting 23.50% of the total and worth $239.44M.

Number of RE transactions by December 2023:

Source: CADASTRE, BLOMINVEST

Disclaimer :

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.