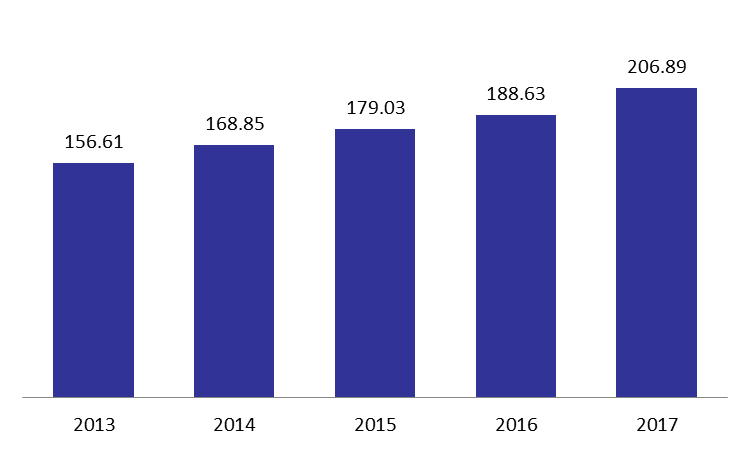

According to the Central Bank of Lebanon (BDL), total assets of commercial banks increased by 1.26% year-to-date (y-t-d) to reach a value of $206.89B.

The increase in total assets was mainly due to the upturn of 2 % y-t-d in claims on the resident private sector that reached $52.06B by May. Claims in LBP increased by 6.5% y-t-d to $35.38B while claims in foreign currencies remained stable at $16.68B by May 2017.

Foreign Assets also went up by 10.66% since year start to $25.56B. In details, claims on the non-resident private sector dropped by 5.29% y-t-d to $5.82B while claims on the non-resident financial sector increased by 24.75% y-t-d to $14.02B

Claims on the public sector advanced by 7.81% y-t-d to $37.43B with banks’ subscription to treasury bills (LBP) and to Eurobonds rising by 9.14% and 6.31% y-t-d to $20.95B and $16.35B, respectively.

On the liabilities’ side, resident private sector deposits rose by 2.54% to $131.8B with deposits in LBP advancing at a rate of 0.27% y-t-d to $51.15B and deposits in foreign currencies increasing at a rate of 4.04% y-t-d to $80.65B.

Non-resident private sector deposits rose by 1.11% to $34.34B with LBP deposits declining by 3.48% y-t-d to $4.37B and with foreign currency deposits rising by 1.82% y-t-d to $29.97B.

The dollarization ratio of private sector deposits slightly increased from 65.82% in December 2016 to 66.58% in May 2017 while the dollarization ratio of private sector loans slightly decreased from 72.61% to 71.18% during that same period.

Total Commercial Banks’ Assets by May ($B)

Source: BDL