A version of this article appeared in the print edition of The Daily Star on December 06, 2017, on page 4.

Every national government sustains itself by raising money domestically, through taxes, and by borrowing from local parties or external lenders. As such, every population has its “potential to pay tax”, which in turn impacts the local authorities’ revenue collection target every year. Any remaining gap(s) in the national budget is usually financed through borrowing, whether from domestic creditors or from foreign private or public institutions. Foreign aid in the form of grants from some international institutions may also be granted to selective countries if their economies meet particular criteria.

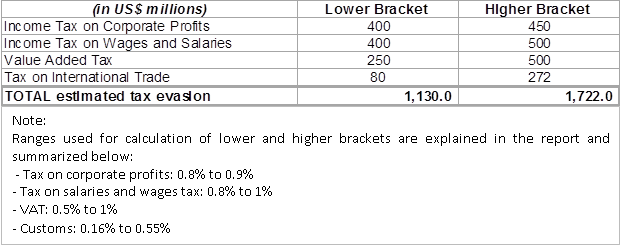

To-date, there is no elaborate study nor sufficient data to conclude exactly how much tax revenues the Lebanese government is being deprived of every year. This can be attributed to imperfections in the tax networks and in the monitoring of all market players operating in the country’s various economic activities. Nonetheless, estimations can be made based on a number of domestic parameters and analyses of international benchmarks.

The report explores the following sections:

Lebanon’s Tax Evasion in Figures

For the full (original) report in PDF format, kindly click below:

Tax Evasion in Lebanon How Much of a Burden

For the shorter version as published in the Daily Star Newspaper:

(PDF) Tax evasion in Lebanon_ How much of a burden_ _ Business , Local _ THE DAILY STAR

Or, follow the Subscribers’ link: https://www.dailystar.com.lb/Business/Local/2017/Dec-06/429047-tax-evasion-in-lebanon-how-much-of-a-burden.ashx