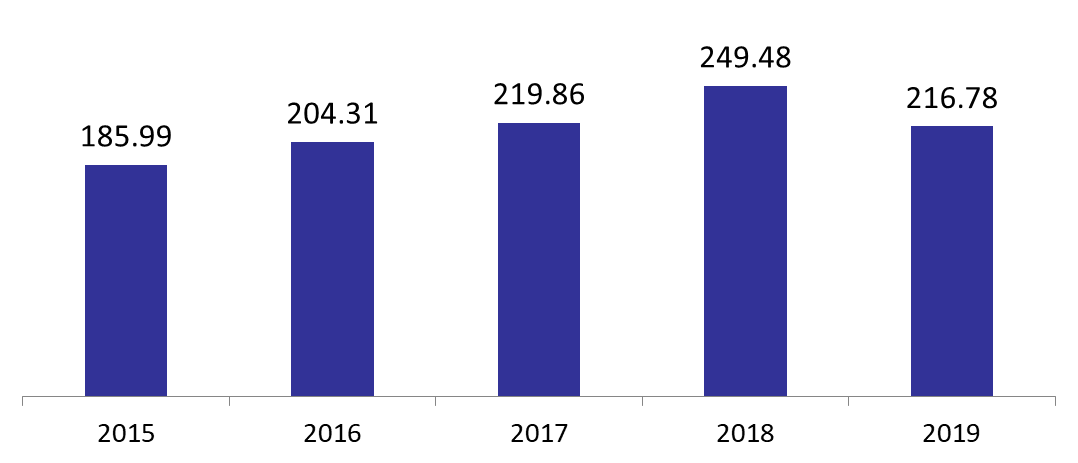

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets declined by 13.11% year-on-year (y-o-y), to stand at $216.78B by December 2019. This is largely explained by the fact that starting December 2019, banks started offsetting their loans taken from BDL in Lebanese pound with their corresponding placements at Banque du Liban in Lebanese pound carrying same maturities. As result, “Deposits with the central bank (BDL)” (Asset Account) and “Other Liabilities” recorded an approximate equal monthly drop by $38B in December.

In details, “Resident customers’ deposits” (which grasp 57.67% of total liabilities) decreased yearly by 7.70% to $125B by December 2019, with deposits in LBP declining by 25.82% to $34.48B while deposits in foreign currencies recorded an uptick of 1.77% to 90.55B. In fact, part of the LBP deposits were converted to USD, which explains the 1.77% uptick in deposits dominated in foreign currencies. Meanwhile, the remaining LBP deposits were withdrawn out of the banking system. As for the “Non-resident customers’ deposits” (14.97% of total liabilities), they retreated by 13.98% y-o-y and totaled $32.45B over the same period on the back of a drop in deposits in LBP and in foreign currencies by 27.19% and 12.27% to $3.14B and $29.31B, respectively. As such, the dollarization ratio for private sector deposits increased from 70.62% in December 2018 to 76.02% in December 2019. In their turn, “Resident financial sector liabilities” witnessed an important yearly increase by 25.49% to $1.38B.

On the assets side, “Reserves” (constituting 54.53% of total assets) recorded a yearly 9.60% drop to settle at $118.21B by December 2019. The slump in reserves came on the back of a 9.59% decline in deposits with the central bank (BDL). Meanwhile, the environment of high interest rates weighted on “Claims on resident customers” (20.26% of total assets) which retreated by 15.22%, to stand at $43.91B in Q4 2019. As for “Claims on the government”, they declined by 14.58% to stand at $30B. In details, the subscription to T-bills in LBP and to Eurobonds recorded a decline by 15.75% and 13.86% to $14.64B and $13.81B, respectively by the end of 2019. Worth mentioning, that “Claims on non-resident Financial Sector” witnessed a significant yearly slump by 43.56% to $6.77B since banks were in liquidity need especially during the last 3 months of year.

Commercial Banks’ Total assets by December (in $Billions)

Source: BDL