The data released by the Ministry of Finance (MoF) recently indicated that Lebanon’s gross public debt hit $94.81B in September 2020, thereby recording an annual increase of 9.3%.

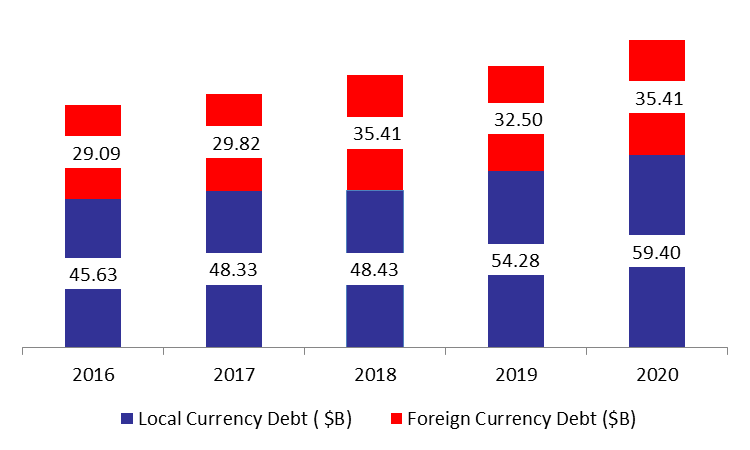

The increase is mainly attributed to the 9.43% annual increase in local currency debt (denominated in LBP) which stood at $59.40B in September 2020. As such, domestic debt constituted 62.65% of the total public debt, compared to last year’s smaller share of 62.55%.

Meanwhile, total debt denominated in foreign currency (namely in USD) climbed by a yearly 8.97% totaling $35.41B over the same period. Therefore, total foreign debt grasped a stake of 37.35% of the total public debt by September 2020, compared to last year’s share of 37.45%. It is worth mentioning that $3.91B represents the Unpaid Eurobonds, their coupons and accrued interests.

Observing the net domestic debt, which excludes public sector deposits with the central bank and commercial banks, it increased by 9.38% annually to $49.66B in September 2020.

It is worth noting that Fitch Rating has affirmed Lebanon’s Long-Term Foreign-Currency Issuer Default Rating at Restricted Default (RD) on August 20, 2020. Moreover, Lebanon’s foreign currency government debt remains in Restricted Default following the default on Eurobond maturity on March 9, 2020.

Lebanon needs to establish new reforms plan as soon as possible to benefit from the IMF program. However, the country needs to count on itself where policymakers must adopt a new economic vision that focuses on the productivity and efficiency of national domestic sectors like industrial and agricultural sectors. In addition, the potential government must stop relying on international aids and must have a plan to reduce the country’s mounting debt. Failing to do so will have a catastrophic effect on the Lebanese economy.

Domestic and Foreign Debt in September ($B)