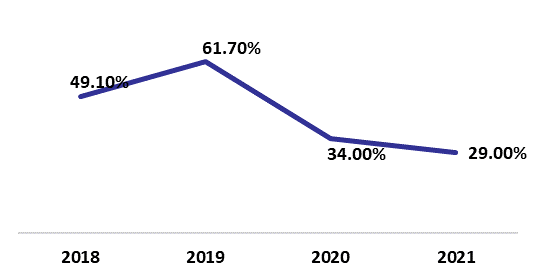

According to Ernst & Young Middle East hotel benchmark survey, the occupancy rate in Beirut’s 4- and 5-star hotels slipped to 29% by January 2021, down from last year’s registered 34% during the same period.

With a severe economic and financial crisis in addition to the measures accompanying the Covid19 spread, full recovery for the tourism and hospitality sector remains difficult. The strict lockdown in Lebanon and the region, including hotels restaurants and pubs, constituted a blow to the sector in Lebanon. As a result, the number of arrival to Beirut airport went down by 71.01% year-on-year (YOY), to stand at 67,076 arrivals in January 2021.

On a monthly performance, Beirut occupancy rate recorded a downtick of 4.5 percentage point (pp) in January 2021 compared to the same period last year. Furthermore, the average room rate has increased by 142.1% from $88 in January 2020 to $213 in January 2021, which led to a RevPAR growth of 110.1% during the same period. Noting that the increase is inflated by valuing the room rates at the official exchange rate of LBP 1,500 per USD.

On a regional level, the occupancy rates in Dubai overall fell by 22.4% year-to-date (YTD) to 64%. By the same token, the Average room rate rose by 1.1% and Room yields fell by 25.1% to stand at $264 and $169, respectively by January 2021.

In turn, in KSA, Makkah and Madinah witnessed notable drops across the board. The cities’ hotel occupancy rate decreased by 66.9 pp and 35.6 pp YTD to 17% and 49% by January 2021. Accordingly, the Average room rate fell by 6.3% and 21.6% to $111 and $102. Moreover, Room yield over the same period fell by 80.8% and 54.6% to reach $19 and $50, respectively. In fact, both Emara’s hospitality sector has suffered the most due to entry restrictions for pilgrims to the Holy Mosque.

The hospitality sector in Lebanon is no longer able to withstand any more setbacks, exacerbated by crisis of the Beirut Port explosion and the political conflicts. Moreover, the Arab tourists historically made up the bulk of the tourists in Lebanon, and with their absence and no expectation for their returns any time soon, the sector is not expected to improve in the upcoming period.

The first month of 2021 was particularly challenging for Lebanon, particularly the hospitality sector given the spread of Covid-19 and disrupted business activity. Moreover, tourism, one of Lebanon’s main growth drivers, suffered the most, given that restaurants, hotels and Ski resorts were closed due to the lockdown measures against the pandemic.

Yearly Occupancy Rates in Beirut’s 4&5-Star Hotels

Sources: BLOMINVEST, Ernst & Young