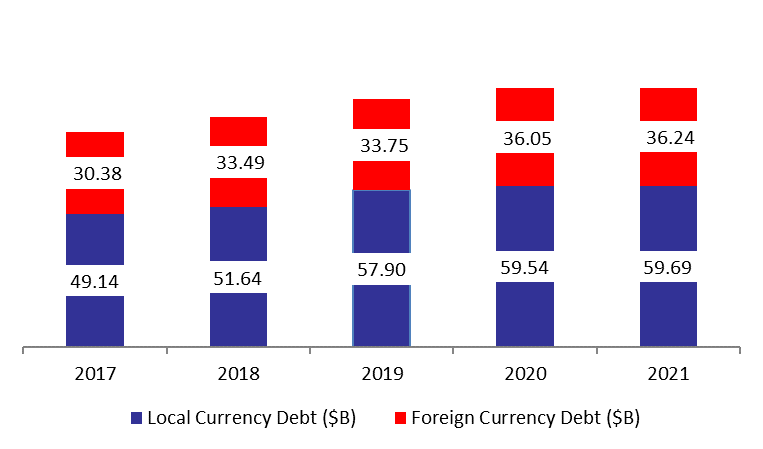

The data released by the Ministry of Finance (MoF) recently, indicated that Lebanon’s gross public debt hit $95.94B in the first month of 2021, thereby recording an annual increase of 4.3%.

The rise is mainly attributed to the annual increase in both local and foreign currency debt by 2.83% and 6.77%, respectively. In details, debt in local currency (denominated in LBP) stood at $59.69B in January 2021. As such, domestic debt constituted 62.22% of the total public debt.

Meanwhile, total debt denominated in foreign currency (namely in USD) reached $36.24B over the same period. Therefore, total foreign debt grasped a stake of 37.78% of the total public debt by January 2021. It is worth mentioning that $4.91B represents the unpaid Eurobonds, their coupons and accrued interests, due to the default on government Eurobonds in March 2020.

Looking at net domestic debt, which excludes public sector deposits with the central bank and commercial banks, it increased by 5.56% annually to $50.08B in January 2021.

Lebanon’s political, economic, and financial situation is highly uncertain along with a high debt-to-GDP ratio at more than 180% in 2020. Moreover, regarding the exchange rate, the spread between the official exchange rate and the parallel market is displayed to be around 700%, as a result of which the Central Bank has subsidized the imports of basic products like fuel by using the official exchange rate. More important, this spread implies that the USD value of local debt is drastically reduced when valued at the parallel market rate, reducing it to less than $5B.

.

Domestic and Foreign Debt by January ($B)