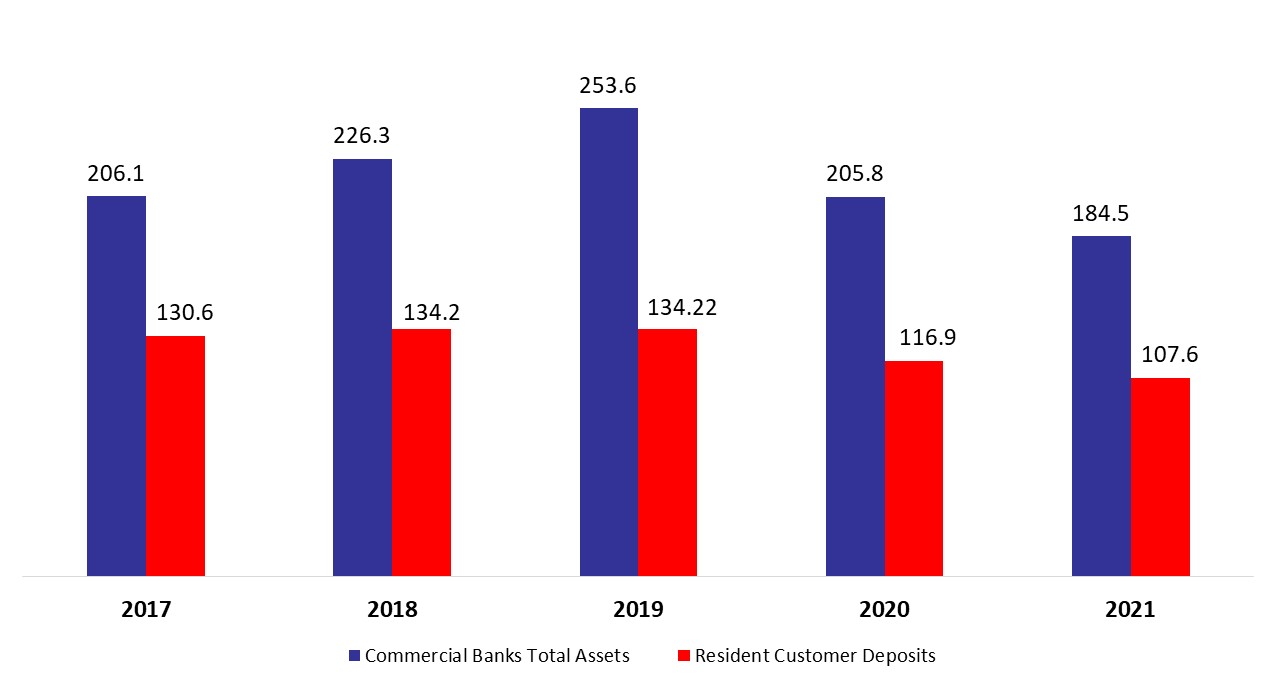

Lebanese banks today are surrounded by an increasingly volatile environment, fierce challenges and growing problems that are taxing their capabilities during the continuous financial crisis. In turn, total assets of Lebanese commercial banks decreased by 1.87%, year-to-date (y-t-d), and stood at $184.52B in April 2021, according to Lebanon’s consolidated commercial banks’ balance sheet.

In details, resident customers’ deposits (which grasp 58.31% of total liabilities) decreased since December 2020 by 2.39% to $107.59B in April 2021, with deposits in LBP down ticked by 2.81% to $23.74B while the deposits in foreign currencies declined by 2.28% to stand at $83.85B.

As for Non-resident customers’ deposits grasping 14.54% of total liabilities, recorded a drop of 1.92% and stood at $26.82B over the same period. In fact, the deposits in LBP retreated by 2.39% to reach $2.2B while deposits in foreign currencies declined by 1.88% and totaled $24.62B in April 2021. More importantly, the dollarization ratio for private sector deposits increased from 78.94% in April 2020 to 80.43% in April 2021. In addition, Non-resident financial sector Liabilities held 2.92% of total Liabilities and dwindled by 18.26% to reach $5.38B y-t-d.

On the assets side, Reserves, constituting 60.24% of total assets, recorded a y-t-d downtick of 0.33% to settle at $111.16B in April 2021. Deposits with the central bank (BDL), grasping 98.68% of total reserves, witnessed a slight y-t-d decrease of 0.66% to reach $109.7B.

Meanwhile, Claims on resident customers, constituting 15.85% of total assets, shrank by 7.95%, to stand at $29.24B in April 2021. The drop in the loans portfolio followed the early settlement of some loans from related customers’ deposits through a netting process in fear of a haircut on deposits or a formal devaluation of the currency. Moreover, Resident Securities portfolio (11.83% of total assets) dropped by 2.87% during April to stand at $21.82B. Specifically, the subscriptions in T-bills in LBP added 1.38% to reach $11.61B in April 2021 while the subscriptions in Eurobonds recorded a decline of 10.64% and totaled $8.39B for the same period, as banks are selling their Eurobond holdings to share up their foreign currency liquidity. In addition, claims on non-resident financial sector slumped by 8.47% to record $4.31B in April 2021, perhaps to settle some of the non-resident financial sector liabilities mentioned above.

For years, the banking system in Lebanon used to provide a short-term solution to a long-term problem. In this context, the Central Bank published during this week its basic circular 158 that opens the way for depositors to receive gradually part of their foreign currency deposits. This circular may ease the situation for the small depositors; however it may contribute to increase the money in circulation as well as may impose more pressure on the Lebanese pound.

Commercial Banks Assets and Residents Customer Deposits by April ($B)

Source: BDL, BLOMINVEST