In a report on Lebanon released on 16 September 2021, the IIF noted that a “new cabinet was formed, after a 13-month political vacuum, with key ministries shared between sectarian political parties. However, it is encouraging that the ranks of new ministers include several independent technocrats. We expect a 50% chance to carry out the reforms needed to achieve macroeconomic stability and arrest further deterioration, which would lead to an agreement with the IMF and unlock financial support from the international community. Since 2018, real GDP shrank by 42% – a result of mismanagement, corruption, more recently the pandemic and Beirut explosion. The Lebanese pound has lost 90% of its value on the parallel market in less than 2 years, triggering triple-digit inflation. Reserves depletion continues, and the Central Bank announced that it will stop subsidizing the import of fuel at the official rate”.

The report added that “key reforms expected by the IMF and the international community include the following: conduct a full audit of the central bank’s accounts and public institutions to improve transparency and accountability; adopt legislation to formalize capital controls; guarantee the independence of the Judiciary Body to reduce corruption and improve accountability; Unify the multiple exchange rates; reform the electricity company (EdL) and eliminate losses; achieve sizable primary fiscal surplus starting in 2022 to put government debt on a firm downward path; restructure the financial system, which will involve recapitalization and bank mergers; set up an expanded social safety net to protect the most vulnerable people”.

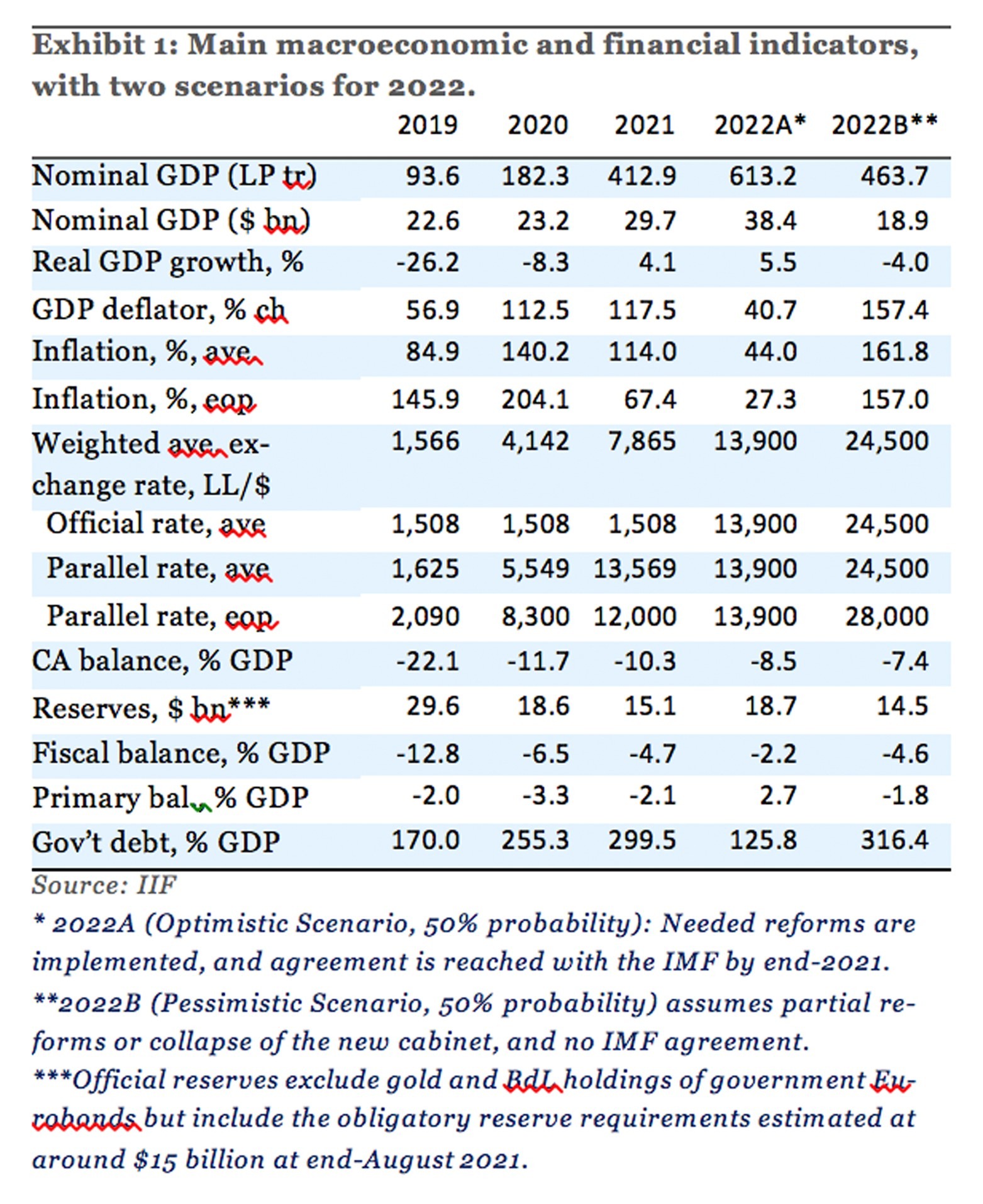

Given the uncertainty on the implementation of reforms and an IMF agreement, the report “prepared two possible scenarios. The Optimistic Scenario (50% probability) assumes that the new cabinet will be allowed to implement the urgent economic reforms, which will be endorsed fully by the parliament and lead to an IMF agreement before the end of this year. Such a scenario would facilitate access to additional, desperately needed aid from other multilateral sources. In this case, real GDP growth could start to recover to around 4% in 2022 (albeit from very low base). The inflationary pressure resulting from cuts to subsidies on essential goods could be partly offset by a significant appreciation of the parallel exchange rate. We expect the average inflation rate to decline from 140% in 2021 to 114% in 2022. The current account deficit, which narrowed to an estimated 11.7% of GDP in 2020 supported by the 40% drop in imports, is projected to decline further to 8.5% of GDP in 2022 and 6.4% by 2025. The fiscal primary balance will also improve, shifting from a deficit of 1.6% of GDP in 2021 to a surplus of 0.7% in 2022, which will continue to improve to a surplus of 4.3% of GDP by 2025. And the government debt-to-GDP ratio could be reduced from around 300% in 2021 to 126% in 2022 and 84% by 2025”.

However, the “Pessimistic Scenario (50% chance) assumes partial reforms or resignation of the government, no agreement with the IMF, and lack of adequate external financing. Under such a scenario, Lebanon’s economy would contract again, the parallel exchange rate would depreciate further, perhaps to more than LP28,000 by end 2022, inflation would remain well above 170% for several years, the official available reserves would be depleted, and the public debt-to-GDP ratio will remain well above 300%”.