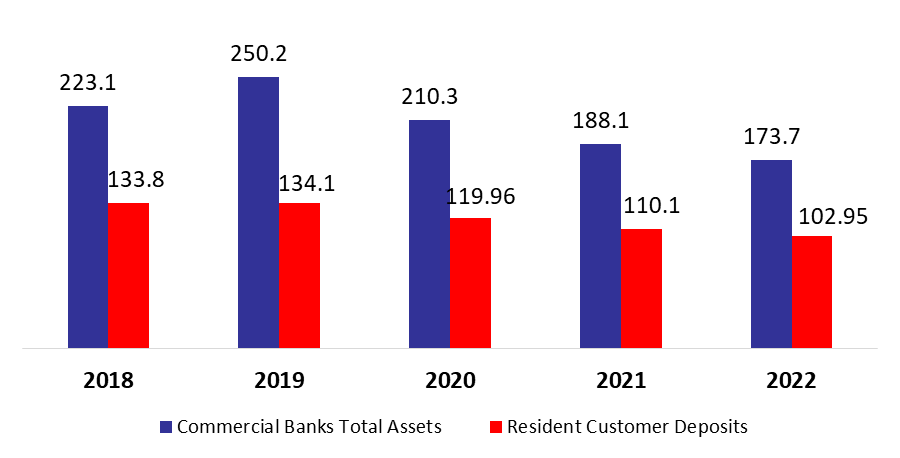

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased annually by 7.66% to stand at $173.73B by February 2022.

In more details, resident customers’ deposits which grasp 59.26% of total liabilities decreased by 6.47% to $102.95B in February 2022, with deposits in LBP down ticked by 2.15% to $24.32 B. Moreover, the deposits in foreign currencies declined by 7.72% to stand at $78.64B.

As for Non-resident customers’ deposits grasping 13.94% of total liabilities, they recorded a drop of 11.07% and stood at $24.22B over the same period. In details, the deposits in LBP retreated by 10.69% to reach $1.97B while deposits in foreign currencies declined by 11.11% and totaled $22.23B in February 2022. More importantly, the dollarization ratio for private sector deposits decreased from 80.04% in February 2021 to 79.05% in February 2022. In addition, Non-resident financial sector Liabilities held 2.77% of total Liabilities and dwindled by 25.55% to reach $4.81B YOY.

On the assets side, currency and deposits with Central Bank, constituting 64.99% of total assets, recorded a yearly uptick of 1.21% to settle at $112.91B in February 2022. Deposits with the central bank (BDL), grasping 97.19% of total reserves, witnessed a slight annual decrease of 0.59% to reach $109.74B.

Meanwhile, Claims on resident customers, constituting 13.70% of total assets, shrank by 24.17%, to stand at $23.8B in February 2022. Moreover, Resident Securities portfolio (9.75% of total assets) dropped by 24.92% in February 2022 to stand at $16.94B.

Commercial Banks Assets and Residents Customer Deposits by February ($B)