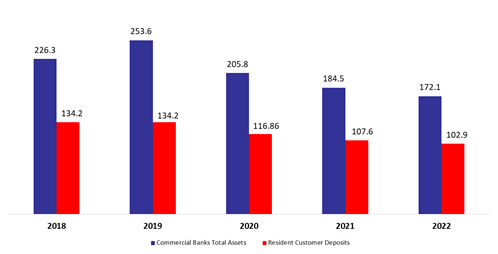

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased annually by 6.72% to stand at $172.1B by April 2022.

On the liabilities side, resident customers’ deposits were the main account, representing 59.77% of total liabilities; they decreased by 4.38% since April 2021 to reach $102.9B in April 2022. In more details, deposits in foreign currencies (75% of resident customers’ deposits) decreased remarkably by 7.87% YOY in April 2022, while deposits in LBP (25% of resident customers’ deposits) increased substantially by 7.96% in April 2022. This phenomenon is justified by the fact that some depositors are withdrawing their whole USD limit, imposed by the bank, every month, while others are more and more depositing instalments in LBP.

As for Non-resident customers’ deposits, grasping 13.92% of total liabilities, they recorded a drop of 10.70% and stood at $23.956B in April 2022. In details, the deposits in LBP retracted by 8% to reach $2.027B while deposits in foreign currencies declined by 10.94% to reach $21.93B over the same period. More importantly, the dollarization ratio for private sector deposits decreased from 80.43% in April 2021 to 77.96% in April 2022. In addition, Non-resident financial sector Liabilities held 2.57% of total Liabilities and decreased by 17.67% to reach $4.43B YOY. It is interesting to reflect that resident and non-resident customers’ deposit represent 73.7% of total liabilities.

On the assets side, currency and deposits with Central Bank, represented a high figure of 65.71% of total assets; they recorded a yearly uptick of 1.74% to settle at $113.1B in April 2022. Deposits with the central bank (BDL) represented 97.66% of total reserves, and slightly increased by 0.69% YOY, to reach $110.45B in April 2022.

Meanwhile, Claims on resident customers, constituting 13% of total assets, shrank significantly by 23.48%, to stand at $22.375B in April 2022. Moreover, Resident Securities portfolio (9.83% of total assets) dropped by 22.45% in April 2022 to stand at $16.92B. More specifically, the Eurobond holding recorded a decline of 46.18% since April 2021, to reach $4.517B in April 2022, as banks are selling their Eurobonds to shore up their foreign currency liquidity.

Commercial Banks Assets and Residents Customer Deposits by April ($B)

Source: BDL, BLOMINVEST