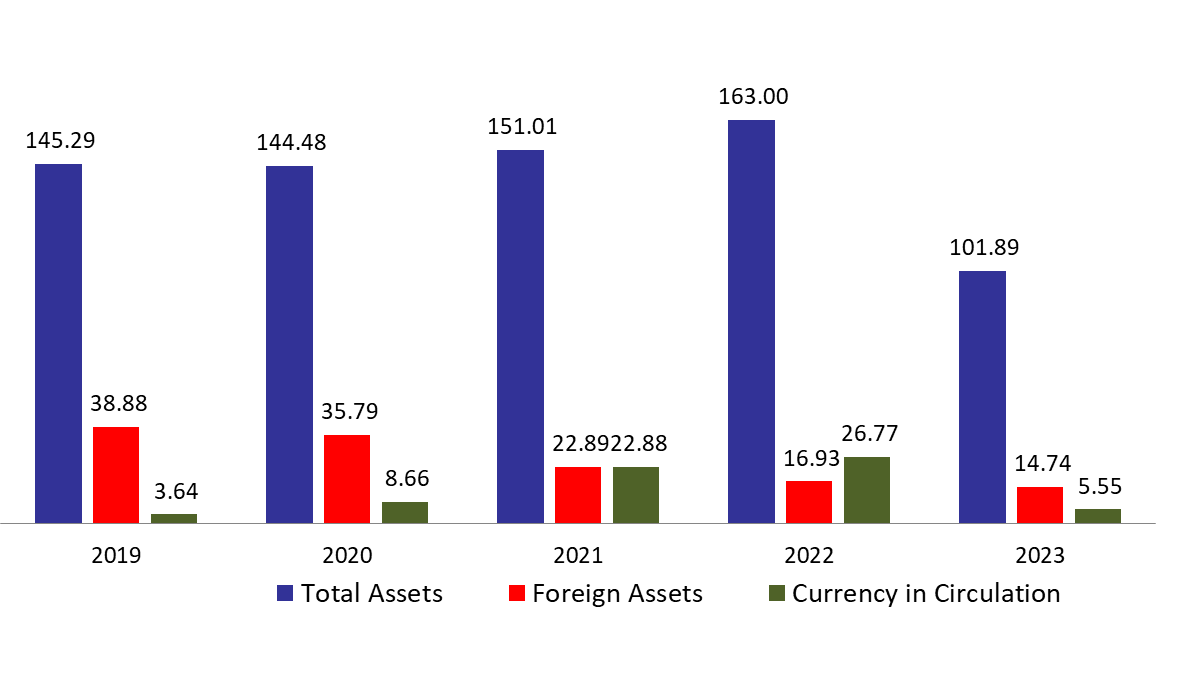

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets fell by 37.49% compared to last year, to reach $101.89B by end of February 2023, amid adopting the 15,000 LBP/USD official rate by BDL. The fall was mainly due to the 83.18% year-on-year (YOY) drop in other assets, grasping 10.09% of BDL’s total assets and reaching $10.28B by end of February 2023. Furthermore, the gold account, representing 16.39% of BDL’s total assets, decreased by 4.85% yearly to reach $16.7B by end of February 2023.

BDL’s foreign assets, consisting of 14.46% of total assets dropped by 12.98% YOY and stood at $14.74B by end of February 2023, noting that BDL holds in its foreign assets $5B in Lebanese Eurobonds. On a different note, total volume of dollars on Sayrafa platform reached $218M in the last two weeks of February 2023 while BDL’s foreign assets decreased only by $79.39M during the same period. Recently, the volume of dollars on Sayrafa platform fell dramatically as the average trading volume reached $24,222K in the last two weeks of February compared to an average of $46,417K in the last two weeks of the previous month of January. Indeed, during the last two weeks of February, Sayrafa was restricted to public sector employees.

On the liabilities front, financial sector deposits, representing 88.05% of BDL’s total liabilities, decreased by 17.85% and reached $89.72B by end of February 2023 compared to last year, of which more than two thirds are denominated in dollars. Lastly, currency in Circulation outside of BDL, consisting of 5.45% of BDL’s total liabilities, plunged by 79.26% annually to reach $5.55B by end of February 2023 amid adopting the 15,000 LBP/USD official rate by BDL. Interesting to note, capital accounts of the Central Bank dropped by 79.73% annually from $3.52B by mid of February 2022 to $715.27M same period this year.

BDL Total, Foreign assets and Currency in Circulation by end of February ($B):

Source: BDL, Blominvest