In its latest World Economic Outlook of October 2023, the International Monetary Fund (IMF) stated that despite showing economic resilience earlier this year, it’s important to remain cautious. The global economy has not fully returned to its pre-pandemic levels, especially in emerging markets and developing economies, and regional disparities are growing. Various factors are impeding the recovery. Some are linked to the enduring impacts of the pandemic, the conflict in Ukraine, and an increasing trend of geo-economics fragmentation. Others are cyclical in nature, such as the effects of tightening monetary policies to combat inflation, the withdrawal of fiscal support in the face of mounting debt, and the disruptive influence of extreme weather events.

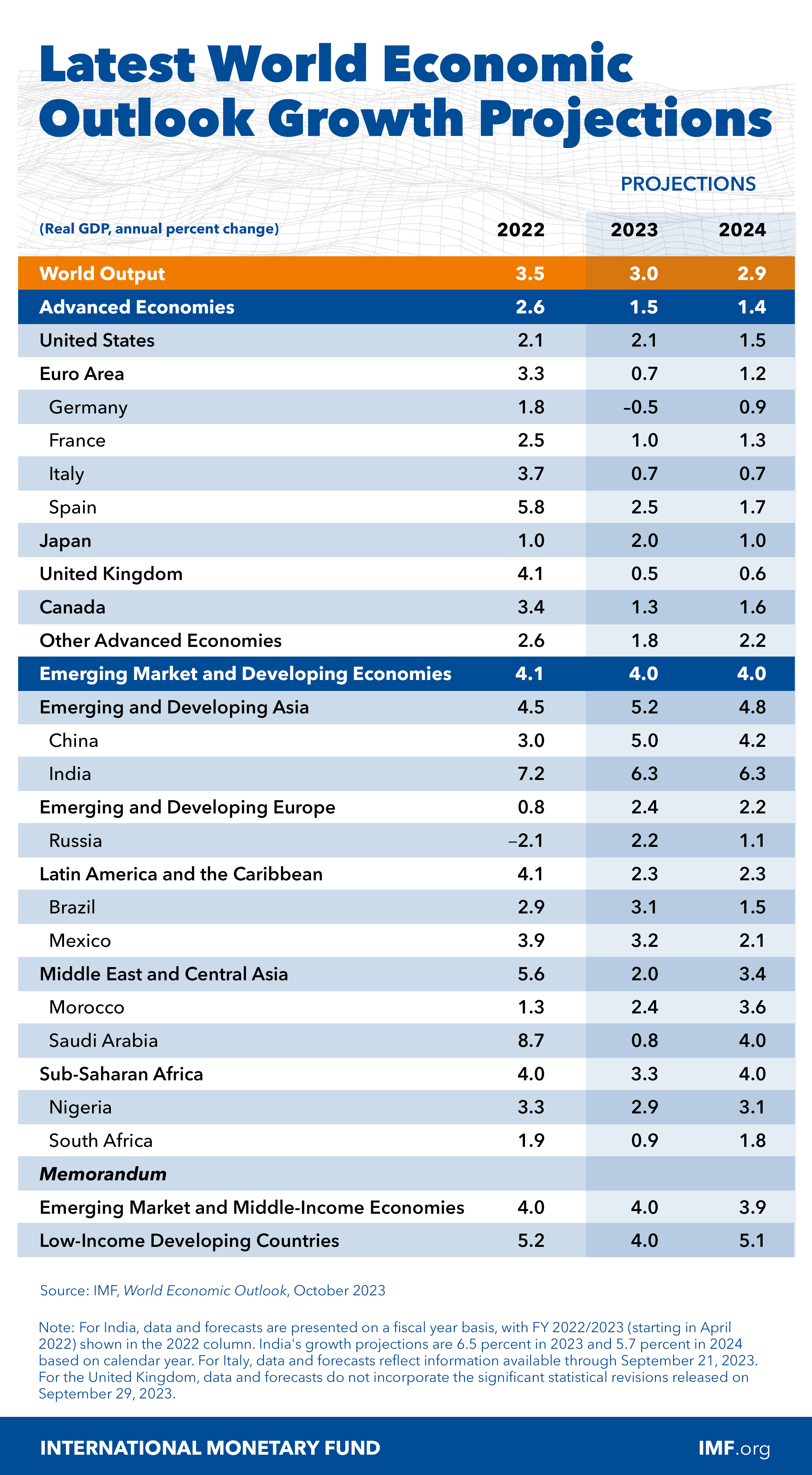

The projected global economic growth is expected to decelerate, dropping from 3.5 percent in 2022 to 3.0 percent in 2023 and further to 2.9 percent in 2024. These estimates fall below the historical average of 3.8 percent between 2000 and 2019. In 2024, the outlook has been adjusted downward by 0.1 percentage point from the July 2023 World Economic Outlook update. Advanced economies are also anticipated to experience a slowdown, declining from 2.6 percent growth in 2022 to 1.5 percent in 2023 and 1.4 percent in 2024. This trend is influenced by robust momentum in the United States but weaker growth in the euro area. Emerging market and developing economies are forecasted to see a modest decrease in growth, moving from 4.1 percent in 2022 to 4.0 percent in both 2023 and 2024, with a 0.1 percentage point reduction in the 2024 projection, primarily due to the property sector crisis in China. Forecasts for global growth in the medium term are historically low at 3.1 percent, with limited prospects for countries to reach higher living standards. Global inflation is predicted to decrease gradually, dropping from 8.7 percent in 2022 to 6.9 percent in 2023 and 5.8 percent in 2024. However, the forecasts for 2023 and 2024 have been adjusted upward by 0.1 and 0.6 percentage points, respectively. It is not anticipated that inflation will return to target levels until 2025 in most cases.

Overall, the global outlook has become more balanced due to the resolution of US debt ceiling tensions and decisive actions by Swiss and US authorities to control financial instability. The risk of a severe economic downturn has decreased, but there are still more downside risks to global growth. China’s property sector crisis could worsen and impact commodity-exporting countries. Inflation expectations have risen, potentially leading to persistent core inflation pressures and the need for higher policy rates. Climate and geopolitical shocks, such as the latest war in Israel-Palestine, might cause food and energy price spikes. Geo-economics fragmentation could disrupt commodity flows, increasing price volatility and complicating the green transition. Many low-income developing countries face high debt risks, leaving little room for policy mistakes. Central banks must balance price stability and address financial stress as necessary.

As a final point, effective monetary policy frameworks and clear communication are crucial for managing expectations and reducing the economic costs of disinflation. Fiscal policymakers should create flexibility in budgets and remove non-targeted measures while safeguarding vulnerable groups. Structural reforms, such as boosting labor market participation, can help achieve inflation targets and reduce debt. Multilateral coordination is essential for resolving debt issues and addressing climate change impacts. Cooperation is also necessary for a smooth transition to a green economy, including securing a stable supply of essential minerals across borders.