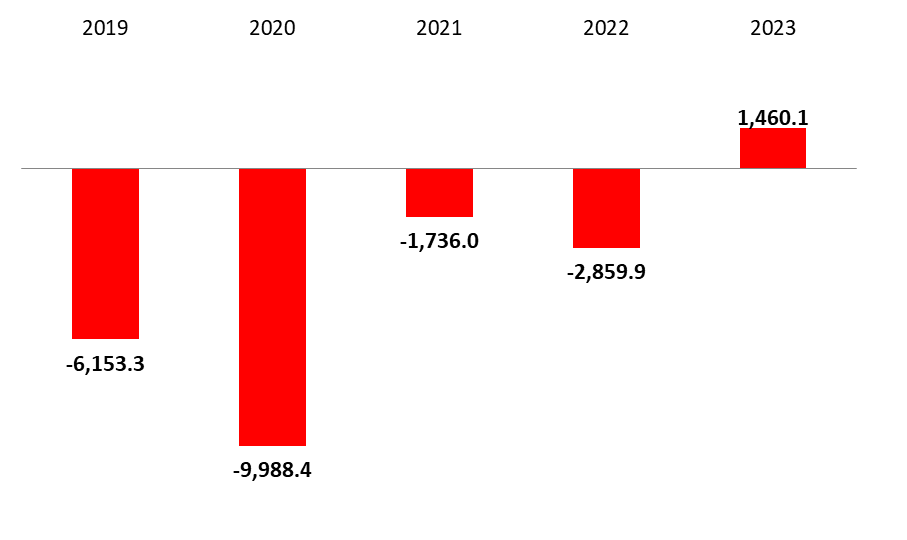

According to BDL’s latest monetary report, the BOP recorded a surplus of $1.46B by October 2023, far beyond the deficit over the same period last year of $2.86B. Accordingly, Net foreign Assets (NFAs) of BDL fell by $1.08B while the NFAs of commercial banks rose by $2.54B by October 2023.

On a monthly basis, the BOP recorded a deficit of $81.2M in October 2023, where the NFA of BDL increased by $179M and NFA of banks dropped by $260.1M. The changes were noticeable on both sides of the commercial banks’ balance sheet; claims on non-resident financial sector dropped by $228.07M and claims on non-resident customers declined by $4.19M, deposits with non-resident central banks retreated by $48.46M, whereas other foreign assets increased by $21.44M and non-resident securities portfolio increased by $53.38M in October 2023. On the liabilities side, non-resident customers deposit rose by $11.18M while non-resident financial sector liabilities declined by $89.26M and non-resident debt securities issued dropped by 7.89M in October 2023.

Balance of Payments (BoP) by October 2023 (in $M)

Source: BDL, BLOMINVEST

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.