On January 31, 2024, the IMF updated its Regional Economic Outlook for the MENA region. On this occasion, Mr Jihad Azour, Director, Middle East and Central Asia Department, stated that the conflict in Gaza and Israel “is having adverse economic consequences on the broader MENA region. It erupted at a time when growth was already slowing in the region and compounded existing challenges. In particular, debt levels remain high, and inflation has not yet been sufficiently brought down in many economies. Today we are releasing a special update to the Regional Economic Outlook to reflect these and other developments in the Middle East and North Africa”

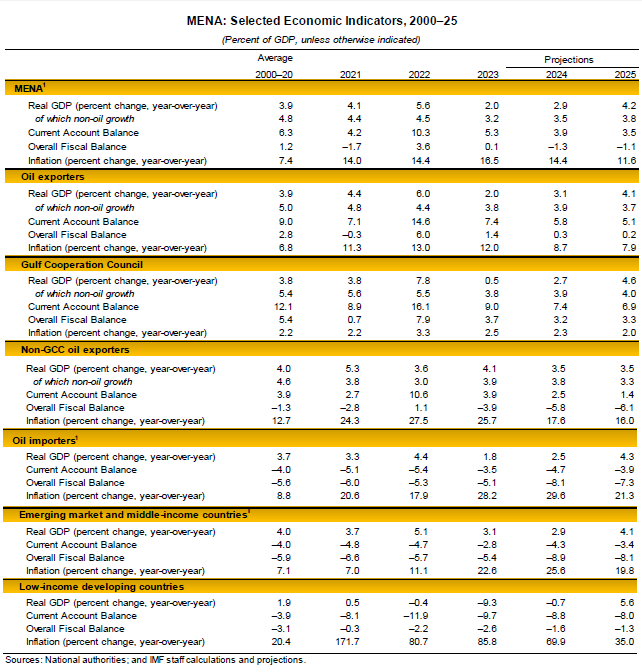

As a result of these developments, “the 2024 growth projection for the MENA region is revised downward by 0.5 percentage point from our October forecasts. We now project GDP to grow by 2.9 percent in 2024 from already weak growth of 2.0 percent in 2023. Various factors are weighing on economic activity:

Given this difficult operating environment, risks abound. As such, “since last October, uncertainty and downside risks for the region’s economies have increased sharply, with the duration of the conflict and scope for escalation still uncertain. The heightened security situation in the Red Sea highlights the ongoing unpredictability and could entail a significant hit to shipping, regional trade, and possibly undersea internet cables. Should the conflict escalate, a more severe or persistent negative impact on tourism could materialize. Higher energy bills and borrowing costs from an unexpected tightening of regional financing conditions could also hold back growth”.

In terms of policy response, the IMF advises that “countries will need to continue to fortify safeguards. Monetary policy will need to remain focused on price stability, and fiscal policy should be tailored to country needs and available fiscal space. Structural reforms to boost growth and strengthen resilience in both the near and longer terms remain critical”.

More specifically, the IMF “is ready and committed to supporting the region. We are already providing policy advice, technical assistance, and financing to MENA countries to help buffer against shocks and ease any necessary adjustment.