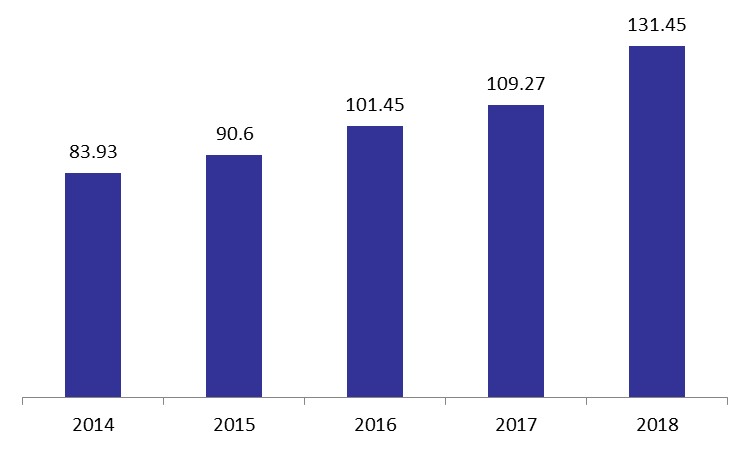

According to the central bank’s (BDL) balance sheet, total assets climbed by 11.15% year-to-date (YTD), to reach $131.45B in July 2018.

In details, BDL’s Foreign assets (constituting 33.79% of total assets) grew by 5.79% since December 2017 to reach $44.42B, while the Securities portfolio (constituting 21.27% of total assets) recorded a 4.49% YTD downtick to settle at $27.95B over the same period. In their turn, Loans to the local financial sector (19.27% of total assets) doubled, rising from $12.73B in December 2017 to $25.32B in July 2018. As for Gold assets (8.55% of total assets), they lost 6.05% YTD, to stand at $11.24B.

On the liabilities side, Financial Sector Deposits (83.28% of BDL’s total liabilities) increased by 12.29% YTD to reach $109.47B in July 2018. This rise is largely linked to BDL’s latest financial engineering scheme by which it extended local currency loans with low interest rates to Lebanese banks. The returns on these loans are deposited at a 10.5% interest rate for 10 years, in exchange for foreign currency deposits. As for Public sector deposits, (4.63% of total liabilities), they grew by 3.27% YTD to $6.09B in July 2018.

Yearly levels of BDL’s Total Assets in July ($B)

Source: BDL