Since October 2019, the financial crisis has triggered a run on the dollar deposits. In fact, customers tried to withdraw their money from their deposit accounts amid the fear that the banks might become insolvent. However, while some depositors preferred to transfer their money abroad or even to keep cash money, others preferred to use their frozen assets and pay back their loans or even buy fixed assets such as properties and real estates which was reflected in Solidere’s consolidated financial statements for 2019.

Solidere’s consolidated financial statements for 2019 revealed a net profit of $48.96M compared to a net loss of $115.7M over the same period in 2018.

In details, Provisions for impairment retreated from highs of $35.05M in 2018 to $18.27M in 2019. In addition, the Write-off of receivables account stood at $606,254 over the same period, down from $33.66M in 2018.

In turn, the company’s Total revenues witnessed a significant growth from $66.23M in 2018 to $295.40M in 2019. This was mainly due to the yearly increase in Revenues from land sales from $1.27M in 2018 to $234.45M in 2019. Meanwhile, Revenues from rented properties decreased from $56.85M in 2018 to $53.21M in 2019.

As to the balance sheet, Total assets registered a yearly loss of 9.36% to stand at $2.25B in 2019. This is mainly justified by the yearly drops in Accounts receivables and in Inventory of land and projects from $146.58M and $1.20B in 2018 to $129.94M and $1.11B in 2019, respectively. Moreover, Solidere has made large payments to its contractors and suppliers, thereby reducing its total liabilities from $698.65M in 2018 to $471.44M in 2019.

Worth mentioning that Solidere issued a Press Release on June 18th 2020 in which it estimates that its non-audited expected sales will total $341.9M in 2020, based on the sales deals concluded and expected throughout the year. The announcement also mentions that the company’s reserve cash at banks grew substantially during 2020 which strengthens the company’s liquidity position and its ability to face challenges.

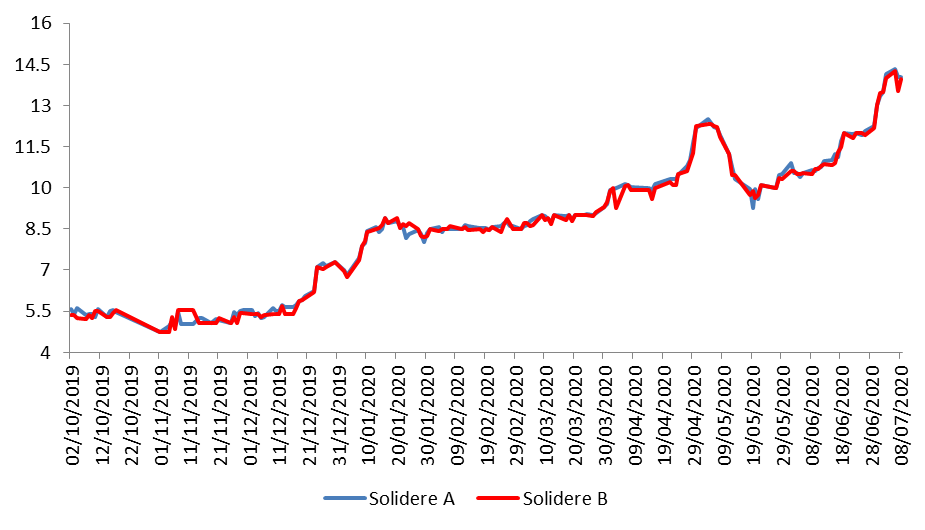

The growth in the real estate sector was positively reflected on the shares of Solidere. In details Solidere A and B shares started 2020 at $7.3 and $7.29 to reach $14.34 and $14.26 on July 6, 2020.

Solidere Stock Price Performance