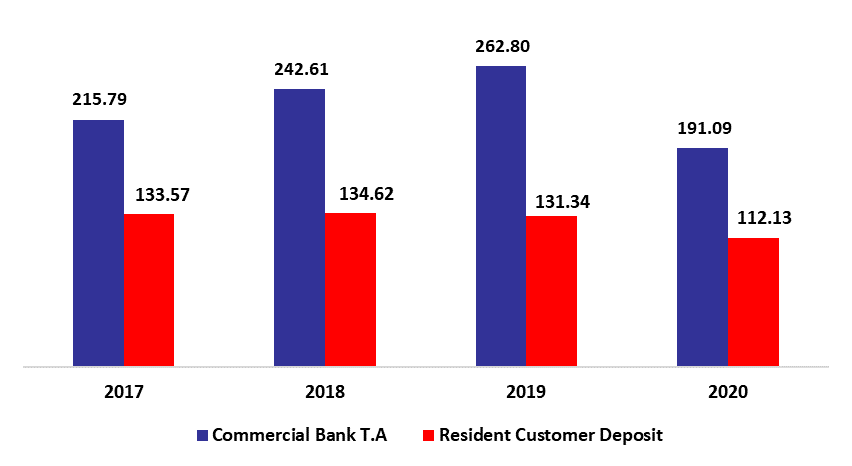

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased by 11.85%, year-to-date (y-t-d), to stand at $191B in October 2020.The decrease started and will likely continue for the upcoming months. Noting that several banks are shutting down more branches in different areas in Lebanon, and some of them are quitting the regional market.

The banking sector in Lebanon was known as a solid pillar in Lebanese economy and had a strong immunity to all Lebanese political conflicts. However, things changed after 17 October 2019, when Lebanese banks were unable to handle all their client’s requests, noting that any bank worldwide can go bankrupt if it receives such big withdrawal demands.

Resident customers’ deposits (which grasp 58.68% of total liabilities) decreased since the start of the year by 10.32% to $112.13B in October 2020, with deposits in LBP and in foreign currencies declining by 27.39% and 3.82% to $25.04B and $87.09B, respectively.

As for the Non-resident customers’ deposits (14.29% of total liabilities), they retreated by 15.85% ($4.47B) and totaled $27.61B over the same period on the back of a drop in deposits in LBP and in foreign currencies by 29.61% and 14.38% to $2.2B and $25.1B, respectively. As such, the dollarization ratio for private sector deposits increased from 76.02% in December 2019 to 80.23% in October 2020.

On the assets side, Reserves (constituting 58.79% of total assets) recorded a y-t-d decline of 4.96% to settle at $112.35B in October 2020. Deposits with the central bank (BDL) (99.23% of total reserves) witnessed a y-t-d drop of 5.30% to reach $111.48B. It is worth mentioning that starting December 2019 (and according to the offsetting criteria in IAS 32 “Financial Instruments: Presentation”), banks have offset their loans taken from BDL in LBP with their corresponding placements at BDL in LBP carrying the same maturities, not to mention the sizeable drop in their loans to the private sector.

Meanwhile, Claims on resident customers (17.33% of total assets) retreated by 24.57%, to stand at $33.13B in October 2020. Moreover, Resident Securities portfolio (12.28% of total assets) declined by 21.94% during the year to stand at $23.46B. In details, the subscription to T-bills in LBP and to Eurobonds recorded a decline by 18.31% and 28.14% to $11.96B and $9.93B, respectively in October 2020. Moreover, claims on non-resident financial sector dropped by 35.20% since the start of the year to record $4.39B in October 2020.

Lebanese banks are facing major challenges as Central Bank governor Riad Salameh had asked all banks in August 2020 to increase their capital by 20% by the end of February 2021 in order to avoid exiting the market. Moreover, the Lebanese banks financial results for 2020 are expected to be worse than last year as confidence in the banking system deteriorates and as financial flows from expatriates continue to drop.

Commercial Banks Assets and Residents Customer Deposits by October ($B)