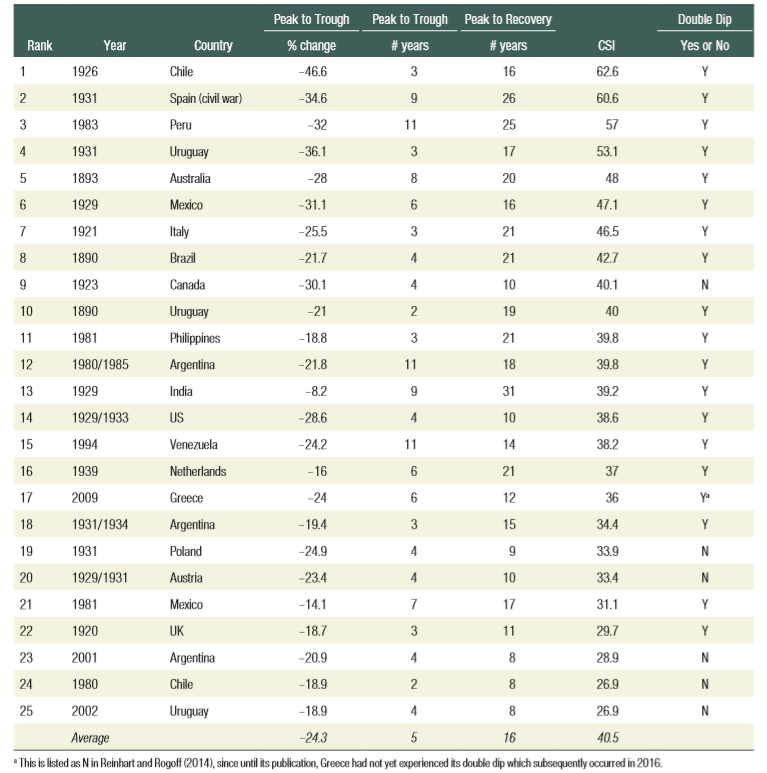

According to the latest World Bank Lebanon Economic Monitor Lebanon Sinking: To the Top 3, “the economic and financial crisis is likely to rank in the top 10, possibly top 3, most severe crises episodes globally since the mid-nineteenth century”. What drives this conclusion is that the “policy responses by Lebanon’s leadership to these challenges have been highly inadequate. The inadequacy is less due to knowledge gaps and quality advice and more the result of: i) a lack of political consensus over effective policy initiatives; and ii) political consensus in defense of a bankrupt economic system, which benefited a few for so long”.

In terms of numbers, the “World Bank estimates that in 2020 real GDP contracted by 20.3 percent, on the back of a 6.7 percent contraction in 2019. In fact, Lebanon’s GDP plummeted from close to US$55 billion in 2018 to an estimated US$33 billion in 2020, while GDP per capita fell by around 40 percent in dollar terms. Such a brutal contraction is usually associated with conflicts or wars. Monetary and financial conditions remain highly volatile; within the context of a multiple exchange rate system, the World Bank average exchange rate depreciated by 129 percent in 2020. The effect on prices has resulted in surging inflation, averaging 84.3 percent in 2020. Subject to extraordinarily high uncertainty, real GDP is projected to contract by a further 9.5 percent in 2021”.

In addition, “conditions in the financial sector continue to deteriorate, while a consensus among key stakeholders on the burden-sharing of losses has proved elusive”. Also, “more than half the population is likely below the national poverty line, with the bulk of the labor force -paid in Lira- suffering from plummeting purchasing power. With the unemployment rate on the rise, an increasing share of households is facing difficulty in accessing basic services, including health care”.

What marks the Spring 2021 Monitor is that it highlights in its Special Foci section “two potential economic triggers that are under increased scrutiny, and which can have significant social implications. The First Special Focus examines Lebanon’s foreign exchange (FX) subsidy for critical and essential imports, which presents a serious political and social challenge, and discusses when and how to remove it. The Second Special Focus discusses the impact of the crises on four basic public services: electricity, water supply, sanitation and education”. In case of the latter, “the sharp deterioration in basic services would have long-term implications: mass migration, loss of learning, poor health outcomes, lack of adequate safety nets, among others. Permanent damage to human capital would be very hard to recover. Perhaps this dimension of the Lebanese crisis makes the Lebanon episode unique compared to other global crises”.

It is hoped that the strong words used would be a wake-up call to form a durable, capable government that will seriously start implementing the country’s needed and long overdue economic reforms.

![]()