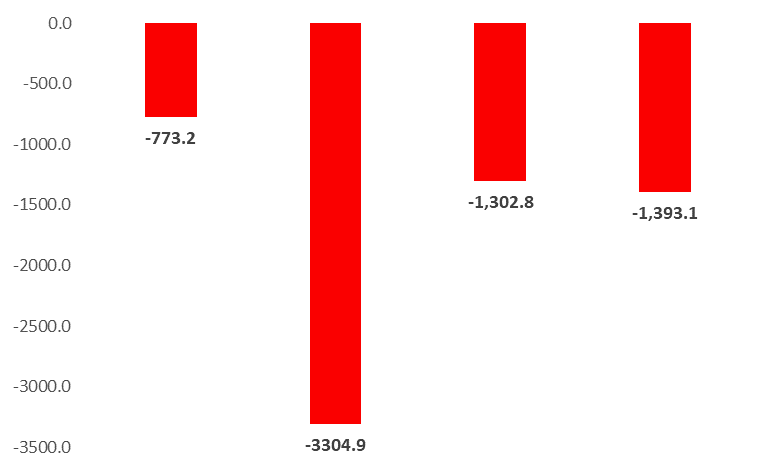

According to BDL’s latest monetary report, the BOP recorded a cumulative deficit of $1,393.1M by April 2021, compared to a deficit of $1,302.8M over the same period last year. Accordingly, Net foreign Assets (NFAs) of BDL fell by $2,370.3M. While the NFAs of commercial banks added $977.2M for April 2021.

On a monthly basis, the BOP deficit stood at $546M, as NFAs of BDL and Commercial banks fell by $515.9M, and $30.1M, respectively.

For a meaningful analysis, we examine the NFAs of commercial banks. For the month of April, the decline in foreign liabilities can be largely attributed to the monthly reduction in the “Non-resident customer deposits” by $63.99M to $26.82B and the reduction in “Non-resident financial sector Liabilities” by $570.98M to $5.38B; while foreign assets mainly decreased owing to the decline by $95.9M in the “Claims on non-resident customers” to $3.7B and the decline in claims on non-resident financial sector by $572.66M to $4.31B.

On the whole, the decline in BDL’s NFAs on a monthly basis is likely attributed to the continued support of essential goods including medicines and fuel. Important to note that Lebanon’s Ministry of Finance said that BDL has less than $1B to continue subsidizing essential goods before reaching required reserves; and BDL is urgently looking into ways to rationalize/eliminate subsidies.

On a related note, BDL issued Circular 157 to banks and Circular 583 to foreign exchange bureaus to launch on Tuesday 11/05/2021 the electronic platform “Sayrafa” for FX transactions. The platform is open to all transactions with proper and exact documentations, and will conduct transactions at the market clearing price, with BDL interfering to control exchange rate price fluctuations when necessary.

Balance of Payments (BoP) by April (in $M)