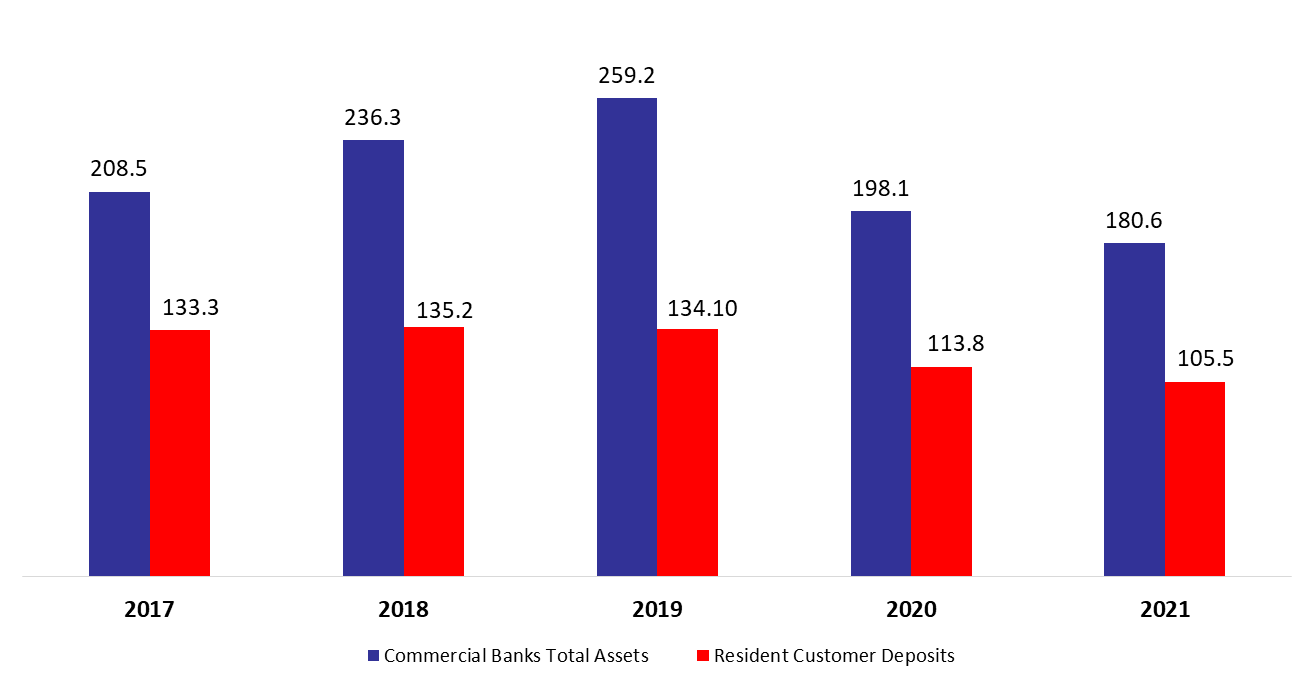

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased by 3.93%, year-to-date (y-t-d), and stood at $180.64B in July 2021, according to Lebanon’s consolidated commercial banks’ balance sheet.

In details, resident customers’ deposits (which grasp 58.38% of total liabilities) decreased since December 2020 by 4.34% to $105.45B in July 2021, with deposits in LBP down ticked by 4.56% to $23.31B while the deposits in foreign currencies declined by 4.28% to stand at $82.13B.

As for Non-resident customers’ deposits grasping 14.48% of total liabilities, they recorded a drop of 4.37% and stood at $26.15B over the same period. In fact, the deposits in LBP retreated by 8.98% to reach $2.05B while deposits in foreign currencies declined by 3.95% and totaled $24.10B in July 2021. More importantly, the dollarization ratio for private sector deposits inscreased from 80.27% in June 2021 to 80.40% in July 2021. In addition, Non-resident financial sector Liabilities held 2.94% of total Liabilities and dwindled by 19.34% to reach $5.31B y-t-d.

On the assets side, Reserves, constituting 60.85% of total assets, recorded a y-t-d downtick of 1.45% to settle at $109.91B in July 2021. Deposits with the central bank (BDL), grasping 98.53% of total reserves, witnessed a slight y-t-d decrease of 1.93% to reach $108.30B.

Meanwhile, Claims on resident customers, constituting 15.15% of total assets, shrank by 13.85%, to stand at $27.36B in July 2021. Moreover, Resident Securities portfolio (11.58% of total assets) dropped by 6.86% during July to stand at $20.92B. Specifically, the subscriptions in T-bills in LBP dropped by 5.48% to reach $10.82B in July 2021 while the Eurobond holding recorded a decline of 13.55% and totaled $8.11B for the same period, as banks are selling their Eurobonds to shore up their foreign currency liquidity. In addition, claims on non-resident financial sector fell 0.30% to record $4.70B in July 2021, perhaps to settle some of the non-resident financial sector liabilities mentioned above.

Overall, the new government in Lebanon will be facing fierce challenges. Comprehensive reforms are critically needed in order to get the international support. In this context, a feasible IMF program would grant Lebanon up to 245% of its IMF quota. However, the possible package of external financial assistance is likely to amount $13B, which is clearly much less than the estimated financial sector losses. As a result, the road to recovery will be tough and not painless.

Commercial Banks Assets and Residents Customer Deposits by July ($B)

Source: BDL, BLOMINVEST