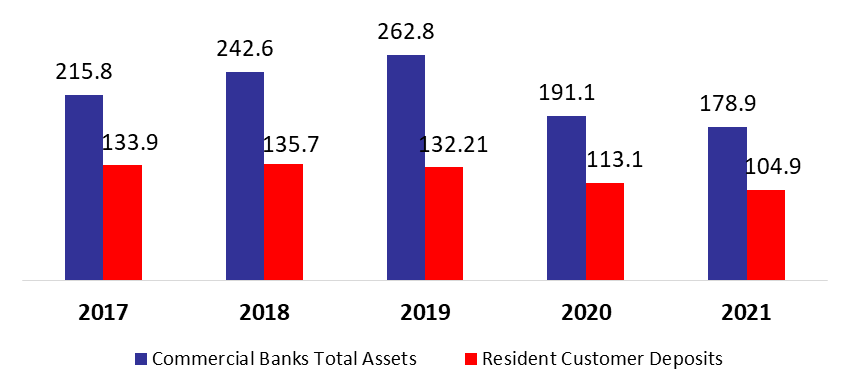

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased by 4.86%, year-to-date (y-t-d), and stood at $178.9B in October 2021, according to Lebanon’s consolidated commercial banks’ balance sheet.

In details, resident customers’ deposits (which grasp 58.26% of total liabilities) decreased since December 2020 by 5.45% to $104.224B in October 2021, with deposits in LBP down ticked by 4.06% to $23.44B while the deposits in foreign currencies declined by 4.06% to stand at $80.78B.

As for Non-resident customers’ deposits grasping 14.43% of total liabilities, they recorded a drop of 5.62% and stood at $25.81B over the same period. In details, the deposits in LBP retreated by 8.58% to reach $2.063B while deposits in foreign currencies declined by 5.35% and totaled $23.75B in October 2021. More importantly, the dollarization ratio for private sector deposits increased from 80.05% in September 2021 to 80.09% in October 2021. In addition, Non-resident financial sector Liabilities held 2.84% of total Liabilities and dwindled by 23.67% to reach $5.02B y-t-d.

On the assets side, Reserves, constituting 62.22% of total assets, recorded a y-t-d downtick of 0.20% to settle at $111.31B in October 2021. Deposits with the central bank (BDL), grasping 97.74% of total reserves, witnessed a slight y-t-d decrease of 1.48% to reach $108.800B.

Meanwhile, Claims on resident customers, constituting 14.23% of total assets, shrank by 19.85%, to stand at $25.46B in October 2021. Moreover, Resident Securities portfolio (11.35% of total assets) dropped by 9.65% during October to stand at $20.30B. Specifically, the Eurobond holding recorded a decline of 27.18% and totaled $6.84B for the same period, as banks are selling their Eurobonds to shore up their foreign currency liquidity.

Interesting to note, that the capital control law will be discussed this week in the parliament, with a low chance that it will pass as many political parties are against it due to its unbalanced nature.

Commercial Banks Assets and Residents Customer Deposits by October ($B)