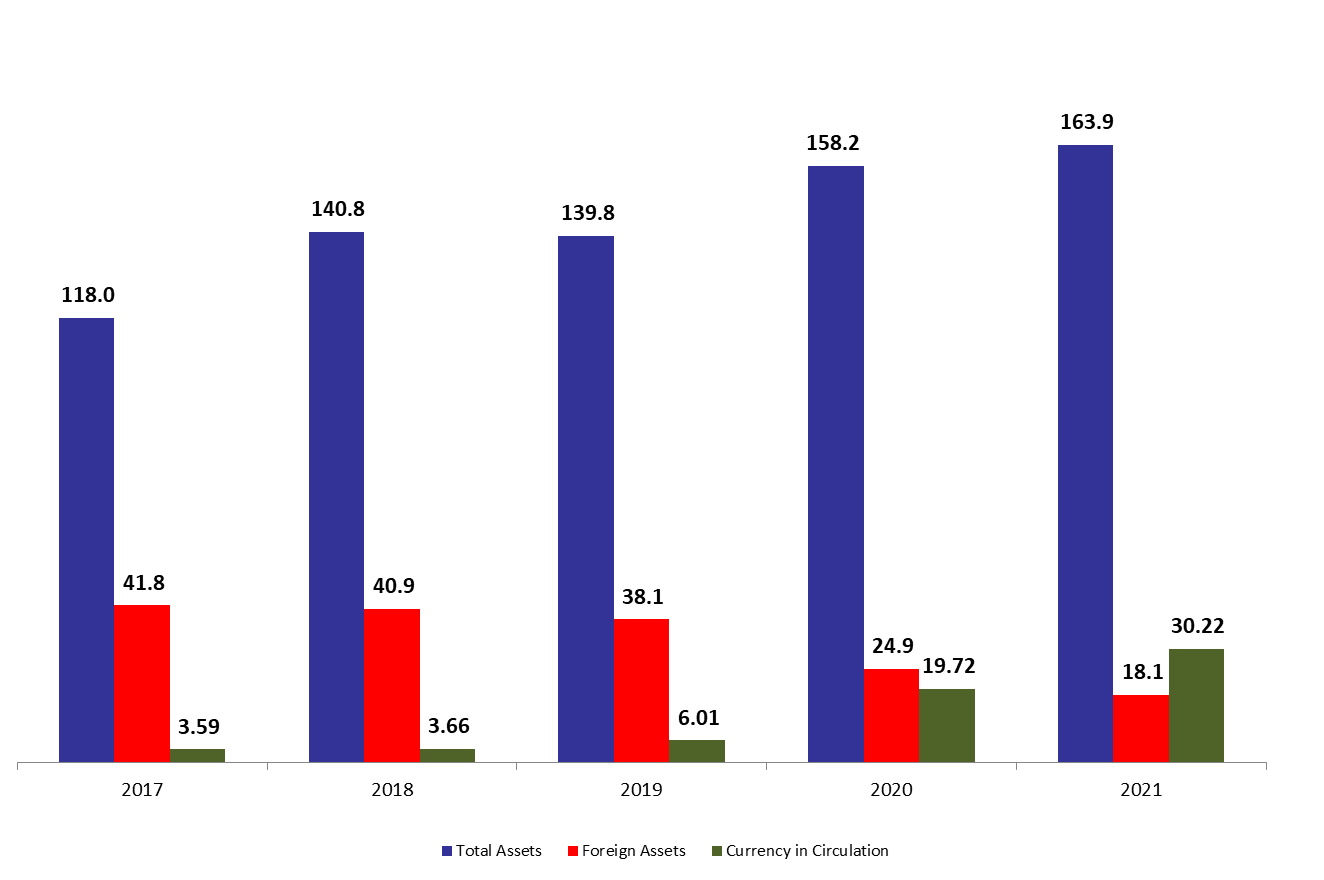

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 3.76% compared to last year, to reach $163.86B by mid December 2021.The increase was mainly due to the 25.26% year-on-year (YOY) rise in other assets, grasping 37.97% of BDL’s total assets and reaching $62.22B by mid December 2021. Meanwhile, the gold account, composing 9.95% of BDL’s total assets, decreased by 4.23% yearly to reach $16.30B by the same period as the international gold price is decreasing globally.

BDL’s foreign assets (grasping 11.04% of total assets) decreased by 27.29% YOY to stand at $18.08B by mid December 2021. Although large part of subsidies on essential products was removed, however the foreign assets are still evaporating since Ogero and electricity expenses are paid in foreign currency and some imports are also funded through “Sayrafa” exchange rate platform.

On the liabilities front, financial sector deposits (65.01% of BDL’s total liabilities) recorded a downtick of 1.13% YOY to settle at $106.52B by mid December 2021, of which more than three are denominated in dollars.

Looking at Currency in Circulation outside of BDL (18.44% of BDL’s total liabilities) it increased by 53.25% jumping from $19.72B by mid of December 2020 to $30.22B by mid December 2021. In fact, new amendment for circular 151 has been issued by BDL setting the exchange rate for dollar deposit withdrawals at 8,000 LBP. This new amendment could lead to higher Lebanese pound liquidity and in turn it would cause further depreciations in the exchange rate.

BDL Total, Foreign assets and Currency in Circulation of mid of December ($B)

Source: BDL, BLOMINVEST