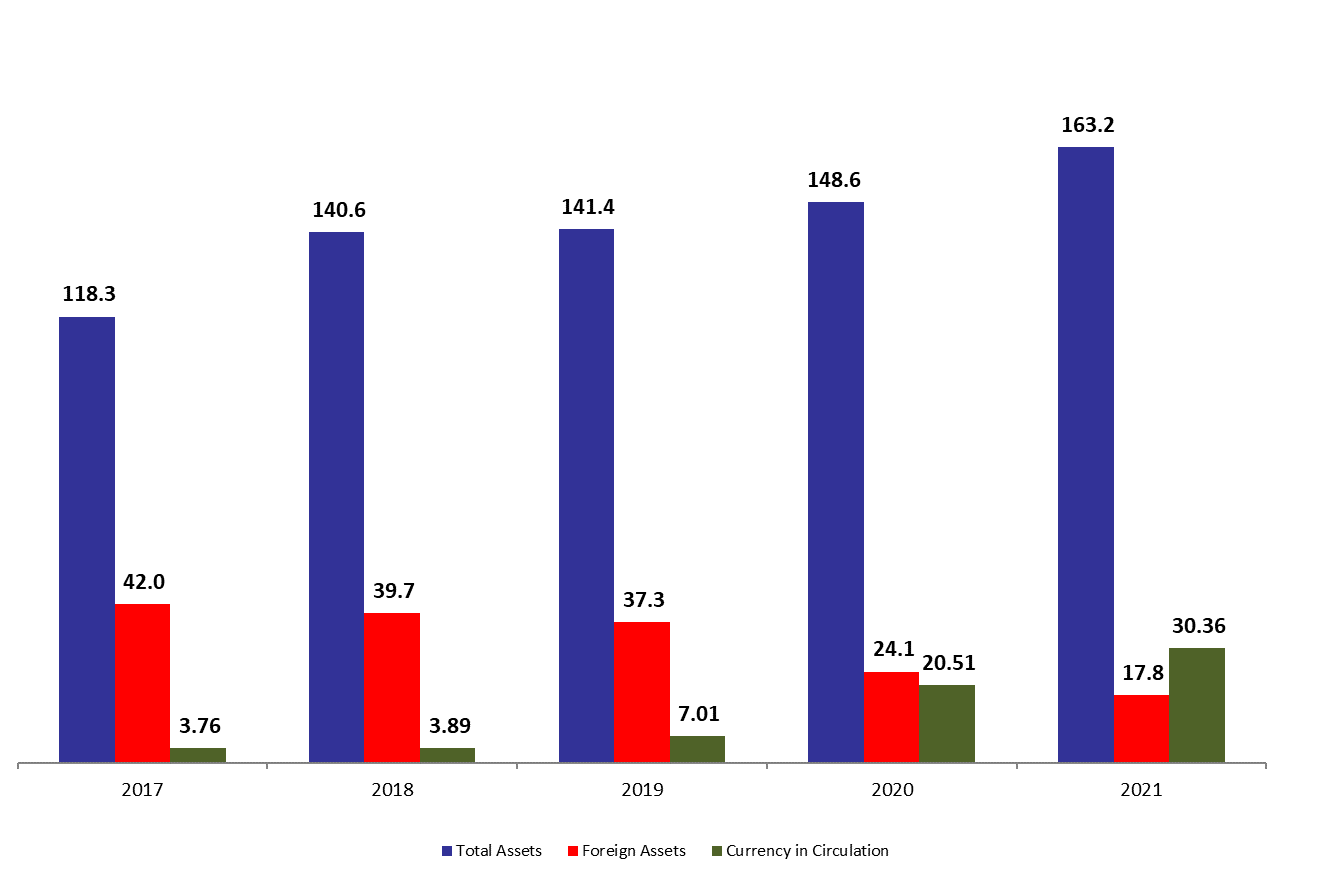

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 9.79% compared to last year, to reach $163.19B by end of December 2021. The increase was mainly due to the 51.07% year-on-year (YOY) rise in other assets, grasping 37.68% of BDL’s total assets and reaching $61.49B by end of December 2021. Meanwhile, the gold account, composing 10.17% of BDL’s total assets, decreased by 4.20% yearly to reach $16.59B by the same period as the international gold price is decreasing globally.

BDL’s foreign assets (grasping 10.92% of total assets) decreased by 25.99% YOY to stand at $17.83B by end of December 2021. Although large part of subsidies on essential products was removed, however the foreign assets are still diminishing as Ogero and electricity expenses are paid in foreign currency and as some imports are funded through the “Sayrafa” exchange rate platform.

On the liabilities front, financial sector deposits (66.15% of BDL’s total liabilities) recorded no change YOY to settle at $107.94 by end of December 2021, of which more than three are denominated in dollars.

Looking at Currency in Circulation outside of BDL (18.6% of BDL’s total liabilities) it increased by 48.01% jumping from $20.5B by end of December 2020 to $30.36B by end of December 2021. In fact, the Lebanese Lira had further depreciated against the dollar early this week to record a new high of USD/LBP 33,500 on Tuesday. The Lebanese Lira then re-picked itself in the parallel market to reach USD/LBP 25,000 by end of week. The drop was a result of the circular number 161 amendment effective as of January 14, 2022. Depositors have the chance to exchange their Lebanese cash holdings to fresh US Dollars at the Sayrafa Exchange rate, USD/LBP 24,700.

BDL Total, Foreign assets and Currency in Circulation of end of December ($B)

Source: BDL, BLOMINVEST