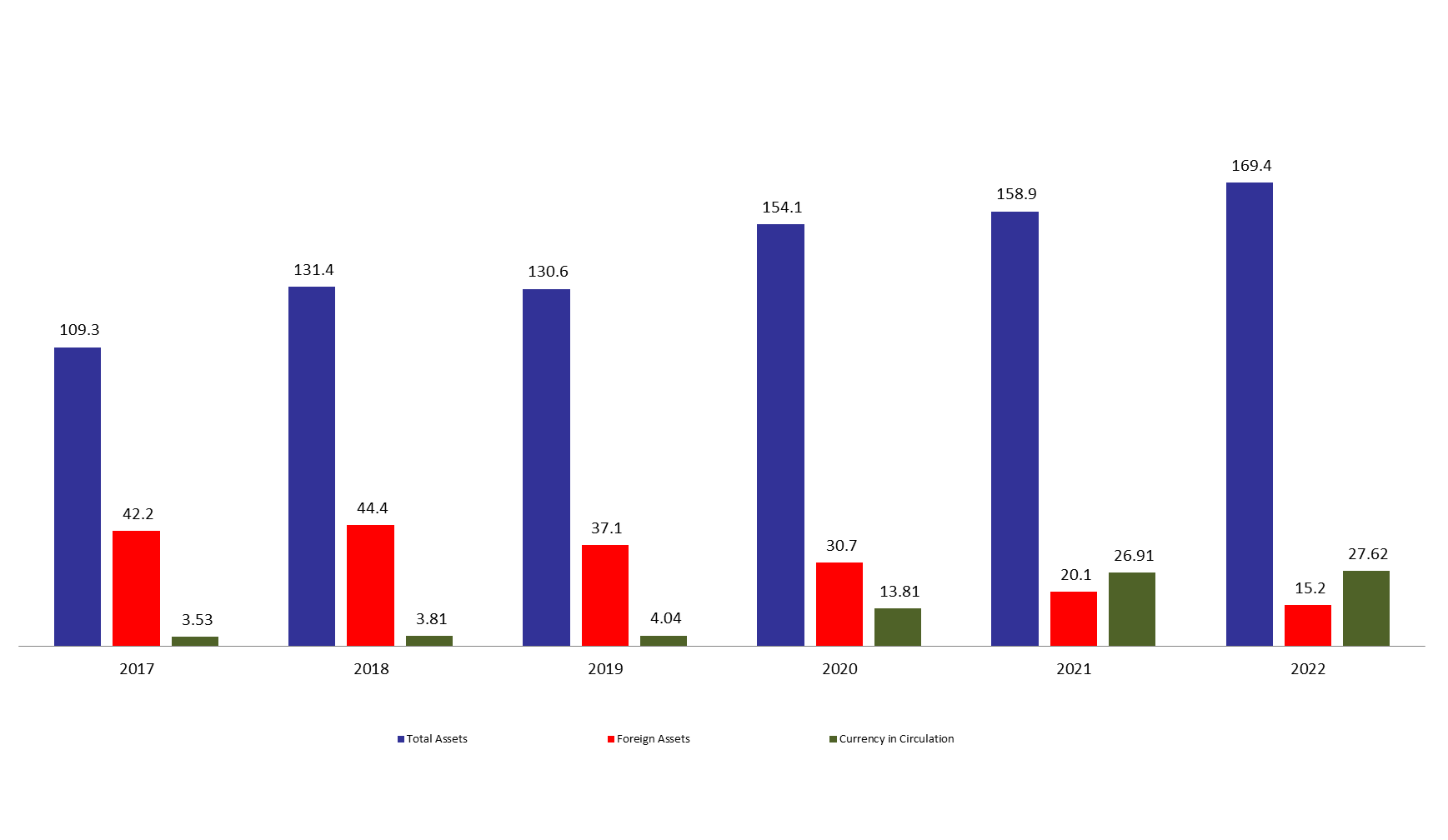

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 6.64% compared to last year, to reach $169.41B by end of July 2022. The increase was mainly due to the 27.75% year-on-year (YOY) rise in other assets, grasping 41.60% of BDL’s total assets and reaching $70.48B by end of July 2022. Nevertheless, the gold account, representing 9.60% of BDL’s total assets, decreased by 3.58% yearly to reach $16.26B by end of July 2022.

Meanwhile, BDL’s foreign assets, grasping 8.95% of total assets, decreased by 24.37% YOY and 14.91% year to date, however, it registered an unusual increase of 0.38% for the last two weeks of July to stand at $15.17B by end of month, though $5B of those are in Lebanese Eurobonds. The increase could be attributed to the fact that the Central Bank has absorbed a bigger amount of foreign currencies from the market compared to the amount traded through Sayrafa platform. For instance, total volume of dollars injected into the market through Sayrafa totaled $232M whereas the foreign assets of BDL expanded by $57.18M during the last two weeks of July. Despite the insignificant uptick, we stick to our opinion regarding the process of Sayrafa to which it is very costly and would lead to the ongoing diminishing of the foreign reserves of the Central Bank under full absence of any reform plan.

On the liabilities front, financial sector deposits, 65.88% of BDL’s total liabilities, increased by 3.96% and reached $111.60B by end of July 2022 compared to last year, of which more than two thirds are denominated in dollars.

Currency in Circulation outside of BDL, consisting of 16.30% of BDL’s total liabilities, increased annually by 2.65% and reached $27.61B by end of July 2022.

BDL Total, Foreign assets and Currency in Circulation by end of July ($B)

Source: BDL, BLOMINVEST