The data released by the Ministry of Finance (MoF) recently indicated that Lebanon’s gross public debt hit $102.47B in January 2023, thereby recording an annual increase of 3.2% YOY.

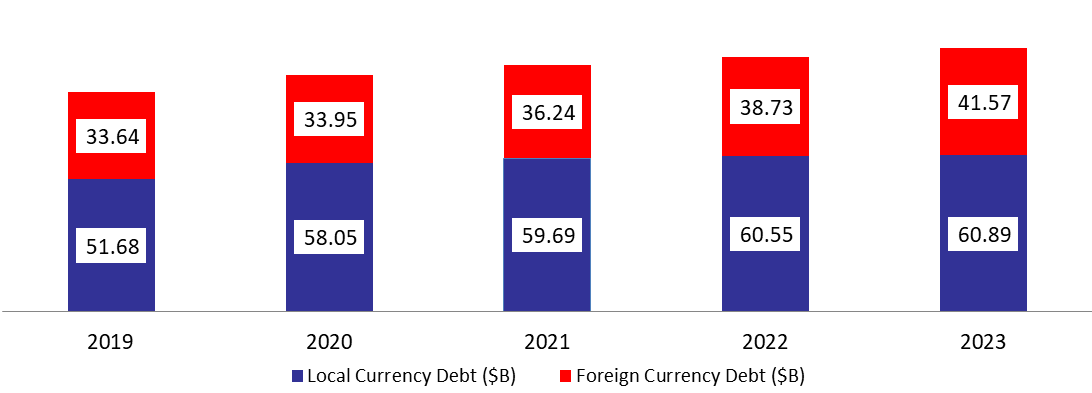

The rise is mainly attributed to the annual increase in foreign currency debt (namely in USD) by 7.35%, to stand at $41.57B by January 2023. In turn, total foreign debt grasped a stake of 40.57% of the total public debt by January 2023. It is worth mentioning that $14.43B represents the unpaid Eurobonds, their coupons and accrued interests, due to the default on government Eurobonds in March 2020. Meanwhile, debt in local currency (denominated in LBP) rose slightly by 0.57% to stand at $60.89B in January 2023, and constituted 59.43% of the total public debt.

Looking at net domestic debt, which excludes public sector deposits with the central bank and commercial banks, it decreased remarkably by 13.97% YOY to $41.85B in January 2023.

Domestic and Foreign Debt by January 2023 ($B)

Source: MoF, BLOMINVEST Bank

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.