According to the World Bank’s latest Migration and Development Brief released on June, 13, 2023, “officially recorded remittance flows to low- and middle-income countries (LMICs) are estimated to grow by 1.4% to $656 billion in 2023 as economic activity in remittance source countries is set to soften, limiting employment and wage gains for migrants”.

The Brief also revises, “upwards 2022’s growth in remittance flows by 8%, reaching $647 billion. In the post-COVID period of slower economic growth and falling foreign direct investments, remittance inflows have become more important to countries and households, given their resilience as a source of external financing, particularly for LMICs with high external debt”.

In terms of the top five recipient countries for remittances in 2022, the ranking was: “India (receiving $111 billion), Mexico ($61 billion), China ($51 billion), the Philippines ($38 billion), and Pakistan ($30 billion). Economies where remittance inflows represent large shares of GDP — highlighting the importance of remittances for funding current account and fiscal shortfalls — include Tajikistan (51% of GDP), Tonga (44%), Lebanon (36%), Samoa (34%) and the Kyrgyz Republic (31%)”.

In terms of regions, remittances to East Asia and the Pacific increased by 0.7% to reach $130 billion in 2022. Remittance flows to Europe and Central Asia grew 19% and registered a record high of $79 billion. The strong performance was due mainly to record high amounts of money transfers from the Russian Federation to neighboring countries. Remittance flows to Latin America and the Caribbean increased by 11.3% to $145 billion aided by the strong U.S. labor market. Remittance flows to South Asia grew by over 12% to $176 billion, benefiting from strong labor market conditions in OECD destination economies, high demand for less skilled migrants in GCC countries, and anti-food price inflation measures that supported migrant incomes in GCC countries. Remittance flows to Sub-Saharan Africa grew by 6.1% to $53 billion.

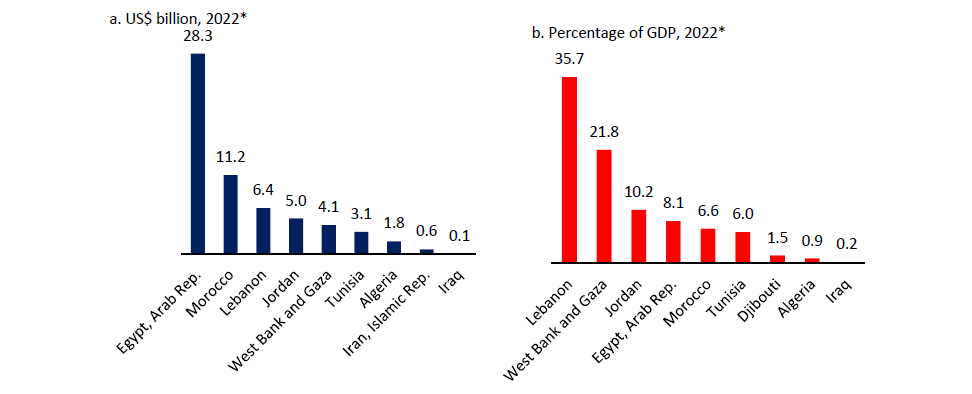

However, growth in remittances to the Middle East and North Africa fell by 3.8% in 2022 to $64 billion after posting strong growth of 12.2% in 2021. Egypt came first at $28.3 billion, Morocco came second at $11.2 billion, and Lebanon came third at $6.4 billion. In 2023, remittance inflows are projected to grow by 1.7% with the outlook differentiated across regional subgroups depending on dominant host countries and the degree of exposure to higher inflation and financial volatility.

Globally, the average cost of “sending $200 was 6.2% in the fourth quarter of 2022, up slightly from 6% a year ago, and more than twice the Sustainable Development Goal target of 3%, according to the Bank’s Remittances Prices Worldwide Database. Banks are the costliest channel for sending remittances, with an average cost of 11.8%, followed by post offices (6.3%), money transfer operators (5.4%), and mobile operators (4.5%). While mobile operations are the cheapest, they account for less than 1% of total transaction volume”.